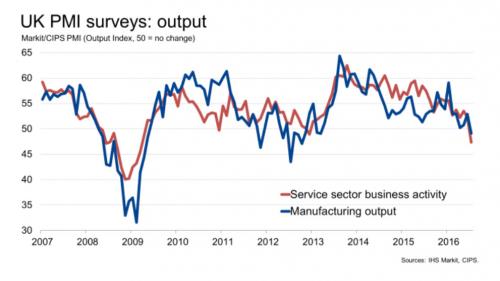

Sterling plummeted nearly 200 pips on Friday, after rising in early trade to just shy of 1.33, when the latest July Markit flash PMI surveys suggested the UK is heading for a quick recession in the form of a 0.4% GDP contraction in the third quarter. Manufacturing PMI tumbled from 52.1 to 49.1, modestly beating expectations, if still the lowest in 41 months, but it was the service economy which imploded, with the Service PMI plunging from 52.3 to 47.4, in line with the worst estimate, and the lowest print in 88 months.

Â

Â

Â

Â

While considered “soft data”, and perhaps suggesting that Markit had not gotten the memo that Brexit fearmongering is now a thing of the past and is instead increasingly spun as positive for the local and global economy, the surveys pointed to the worst performance for more than seven years – when the economy was in the depths of a recession – in the aftermath of Brexit. As a result of renewed recession fear, the pound was trading below 1.31 at last check.Â

Ironically, UK stocks jumped, with the FTSE trading well in the green as traders quickly figured these figures will add to pressure on the Bank of England to cut interest rates next month to cushion the economy from the Brexit blow.

The poor data comes as new Chancellor Philip Hammond indicated the UK could “reset fiscal policy” as data emerges about how the economy has reacted to the vote – indicating a less aggressive approach to cuts aimed at shrinking the deficit than that taken by former chancellor George Osborne.

Markit chief economist Chris Williamson said: “July saw a dramatic deterioration in the economy, with business activity slumping at the fastest rate since the height of the global financial crisis in early 2009.”

He said the downturn – seen in order cancellations, a lack of new orders and the postponement or halting of projects – was “most commonly attributed in one way or another to Brexit”.