In spite of the tough industry backdrop and rising provisions due to energy sector lending, most of the banks that reported second-quarter 2016 results this week managed to beat estimates with their cost-control measures and top-line strength. This also led to positive price movement for most stocks.

Further, the results demonstrated an upswing in loans driven by a rise in commercial loan demand, which ultimately boosted net interest income. Additionally, the rise in deposit balances helped drive organic growth at the banks.

However, an overall rise in non-interest expenses owing to high spending on technology and other market development initiatives was an undermining factor. Moreover, the low-rate environment adversely impacted net interest margins for most of the banks. Nevertheless, the absence of exceptionally high legal expenses helped banks outpace the Zacks Consensus Estimate.

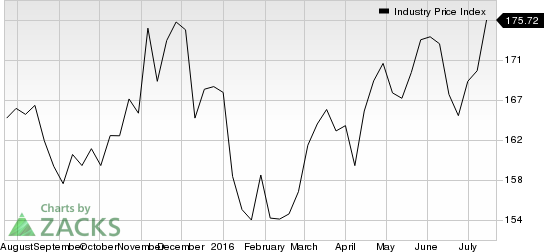

BANKS-MAJOR REGIONAL Industry Price Index