As artificially low interest rates have pushed many income-hungry investors out of traditional fixed income categories and into high-dividend low-volatility stocks such as AT&T (T), those too are starting to look pricey. Some investors are now reaching into covered call strategies to eke out some extra income, but in our view they may be executing this strategy in all the wrong places. For example, AT&T is an income-investor favorite, but its valuation is expensive and selling AT&T calls for additional income is significantly less attractive to us than other high-dividend buy-and-hold options such as the five we’ve highlighted in this article.

AT&T is a Cash Generation Machine, But It’s NOT Cheap:

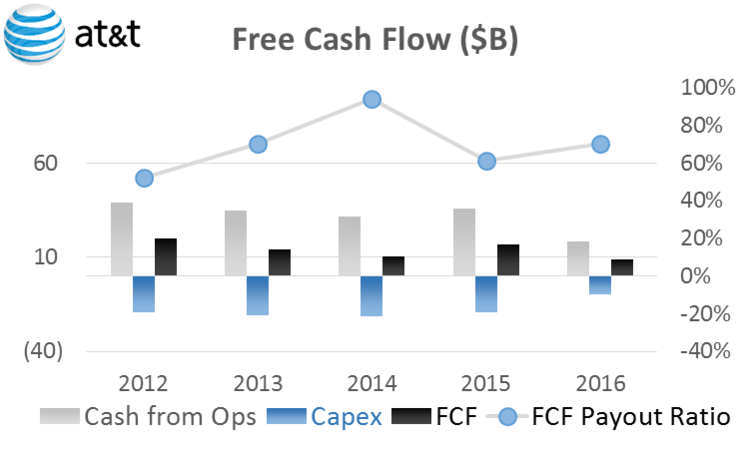

AT&T has generated $8.5 billion in Free Cash Flow so far this year, but it’s also paid out about $6 billion in dividends (and a small amount for share repurchases too). This roughly 70% payout ratio is better than it was prior to the DirecTV acquisition last summer, but it’s going in the wrong direction as shown in the following chart (i.e. a business is not sustainable over the long-term if it pays out more than 100% of the cash it generates).

Additionally, a basic discounted free cash flow model suggests the market is expecting AT&T to shrink by about 0.7% per year into the future. Specifically, we discount YTD FCF of $8.505 billion by a 3.7% CAPM-derived WACC and adjust for outstanding debt to back into the negative 0.7% annual growth rate. And like the climbing payout ratio, the DCF valuation also suggests AT&T will eventually lack the cash flow to pay the dividend (unless they’re able to kick the can down the road again by acquiring another DirecTV or something similar).

The story behind the DCF valuation and rising payout ratio has been the same for years. Specifically, AT&T’s growth businesses (e.g. wireless and now DirecTV) are not expected to grow fast enough to offset its declining businesses (e.g. shrinking wireline as it becomes somewhat obsolete and innovative competition intensifies).

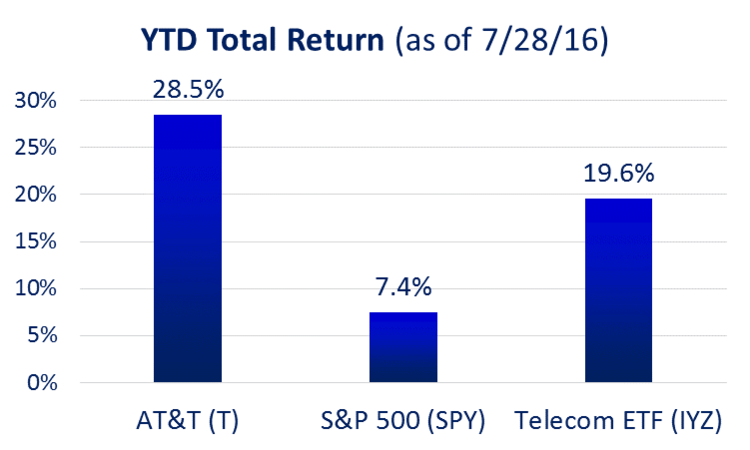

Somewhat ironically, at the same time AT&T’s business faces these challenges, its stock price has appreciated rapidly as the following chart shows.

We believe the stock has increased for two main reasons. First, the DirecTV acquisition provided enough additional free cash flow to successfully patch the dam with regards to the growing free cash flow payout ratio (remember, a company cannot sustainably payout more cash than it brings in). And two, income-investors frustrated with artificially low interest rates continue to bid up the price of low-volatility big-dividend payers such as AT&T.

The Relative Unattractiveness of AT&T Covered Calls:

As mentioned earlier, some investors have turned their efforts to covered call strategies to eke out some extra income in the face of the Fed’s artificially low interest rates. For reference, a covered call strategy involves collecting extra income by selling a call option on a stock you already own. If the price of the stock climbs above the call price it will be taken off your hands (called) at the predetermined call price (you keep the premium and get the cash from the sale). If the call option expires unexecuted, then you keep the stock as well as the premium you received for selling the call.