In a mostly quiet session, European and Asian stocks rose, pushed higher by financial stocks and the USDJPY which initially dipped on some hawkish comments by BOJ deputy governor Iwata, only to rebound later in the session, lifting the Nikkei 1.1%, while the Stoxx 600 rose 0.4% led higher by the banking sector. S&P futures are unchanged after yesterday’s last hour ramp. The key event is the BOE decision due in half an hour, which saw the pound dip initially only for cable to regain all losses in recent trading, despite a 100% price in expectation that Mark Carny will deliver the first interest rate cut in seven years.

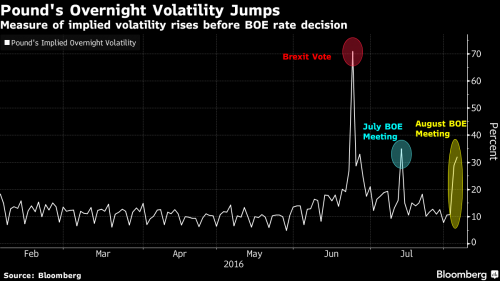

Ahead of the BOE Super Thursday, currency traders are bracing for the BOE to provoke share price swings: a measure of overnight volatility for sterling against the dollar was near the highest since Britain voted to leave the European Union in June according to a Bloomberg report. After holding fire last month, the BOE is expected to cut rates amid mounting evidence that the prospect of Brexit is already hurting economic growth. There are a suite of other measures, including an expansion of its bond-purchase program, which the BOE may also adopt to tackle the fallout, and which would weigh on the pound.

“I think a cut plus 100 billion pounds in new quantitative easing is probably the barrier (to more falls),” said Richard Benson, co-head of portfolio investment at currency fund Millennium Global in London.

“There is quite a lot of speculation regarding what the BOE might do today, so the short-term volatility is to be expected,†said Mark Dowding, a London-based partner and money manager at BlueBay Asset Management LLP. “We doubt the BOE would be opposed to the idea of the pound falling further as it would support the growth outlook, which is deteriorating markedly. We see the pound falling to $1.20 or lower by the end of the year.â€

The Stoxx 600 advanced 0.4 percent in London, after falling 1.9 percent in the first three days of the week. Gauges of lenders and oil companies rallied at least 1.4 percent.Banks led the Stoxx Europe 600 Index higher, while mining shares and energy producers drove the Asian index up from its lowest level since June 24. U.S. crude held above $40 a barrel after the steepest drop in gasoline supplies since April soothed concern over a glut. Industrial metals fell as maintenance-related disruptions in China’s stainless-steel production decreased demand for the raw materials. Siemens AG rose 4.1 percent after increasing its profit outlook for the second time this year. Societe BIC SA jumped 5.6 percent as the maker of pens said sales rose in the second quarter. Aviva Plc advanced 5.1 percent as the British insurer reported a gain in profit and increased its dividend. Randgold Resources Ltd. tumbled 9.5 percent, pacing declines on a measure of Stoxx 600 miners, as a decline in gold output arising from disruptions at two of its African operations led to lower profit.

The MSCI Emerging Markets Index climbed 0.7 percent, after sliding 1.6 percent in the previous two days. Benchmarks in Russia, Dubai and the Philippines gained at least 0.8 percent. S&P 500 futures were little changed, after U.S. equities Wednesday snapped a two-day losing streak amid the rally in oil prices. The index is trading near its highest multiple in more than a decade. Still, investors are looking for clear signs of economic progress after last week’s disappointing growth report, and will asses releases on jobless claims and factory orders due Thursday for clues on the strength of the U.S. economy.The Hang Seng China Enterprises Index of mainland companies listed in Hong Kong rose 0.3 percent, rebounding from the biggest drop in four weeks. The Shanghai Composite Index ended the day up 0.1 percent, after falling as much as 0.7 percent.

Treasuries were little changed, with yields on notes due in a decade steady at 1.55 percent. Ten-year rates jumped at the start of this week, as the record-setting rally in global bonds appeared to falter. Yields on German 10-year bunds lost 1 basis point to minus 0.05 percent.

After yesterday’s torrid rally, WTI fell back under $41, slipping 0.5 percent to $40.50 per barrel, after Wednesday’s 3.3 percent rebound that came when U.S. government data showed gasoline stockpiles fell by 3.26 million barrels last week, the most since April. Brent crude dropped 0.7 percent to $42.82 a barrel.

Market Snapshot

- S&P 500 futures down less than 0.1% to 2157

- Stoxx 600 up 0.5% to 337

- FTSE 100 up less than 0.1% to 6638

- DAX up 0.7% to 10237

- German 10Yr yield down 1bp to -0.05%

- Italian 10Yr yield down 3bps to 1.19%

- Spanish 10Yr yield down 2bps to 1.07%

- S&P GSCI Index down 0.3% to 335.9

- MSCI Asia Pacific up 0.7% to 135

- Nikkei 225 up 1.1% to 16255

- Hang Seng up 0.4% to 21832

- Shanghai Composite up 0.1% to 2982

- S&P/ASX 200 up 0.2% to 5476

- U.S. 10-yr yield up less than 1bp to 1.55%

- Dollar Index up 0.13% to 95.69

- WTI Crude futures down 0.8% to $40.50

- Brent Futures down 0.9% to $42.60

- Gold spot down 0.5% to $1,351

- Silver spot down 1% to $20.20

Top Headline News

- What to Watch as Carney Kicks Off Defense Against Brexit Fallout: Most economists predict reduction in key rate to 0.25%

- Berkshire (BRK-A) Said to Draw Fed Scrutiny Over Wells Fargo Investment: Agencies weigh whether insider-credit limits exceeded at bank

- New York State to Require Hearing on Proposed Anthem-Cigna Deal: Regulator says purchase would reduce competition, hurt firms

- This Time, 3D Printer Makers Think They’ve Found a Sweet Spot: HP says new device cheaper, works 10 times faster than rivals’

- Goldman (GS) Employees to Pull $350m From Och-Ziff Fund: Setback for Och as clients pull assets, U.S. probe continues

- Tesla (TSLA) Forecasts Ease Sting as Quarterly Loss Trails Estimate: Loss was $1.06-share on added engineering costs for Model 3

- Musk Declares Tesla Free From Factory Hell With Targets Intact: Assembly of electric semi, bus could begin in a few years

- MetLife Profit Falls 90% on Review of Annuities Slated for Exit: CEO cites progress in plan to separate business

- Fox (FOX) Profit Tops Estimates as Broadcast TV Registers Gain: Film earnings slump on marketing costs for big summer pictures

- Allstate (ALL) 2Q Adj. EPS, Revenue Top Estimates: Net investment down $27m y/y

- Ackman’s Pershing Square Sells Position in Canadian Pacific: Move comes after transformation of Canadian railway firm