Ever since the collapse of world oil prices in 2014, Canadians have been watching and waiting for the economy to recover. Cautiously optimistic, the Bank of Canada has placed its bets that the recovery will be led by the non-resource sector exports. The Canadian monetary and government authorities have adopted a number of policy measures designed to help the economy adjust to a world of lower commodity prices.These adjustments include:

- The decline in the Canadian/US dollar from roughly parity in 2014 to 75-77 US cents; although this devaluation was market driven, the Bank of Canada’s easing of monetary conditions led the way to a lower Canadian dollar;

- Since January 2015, there have been two reductions in the bank rate as a means of easing business loan conditions and as well  encouraging a depreciation of the Canadian dollar;

- The Federal government, in its March 2016 budget, introduced deficit spending to spur economic recovery, particularly by promising to fund infrastructure projects at the federal, provincial and even municipal level; and,

- Providing as much accommodation as possible to encourage non-resource exports, especially manufacturing and high-tech products.

How have these adjustments performed so far?

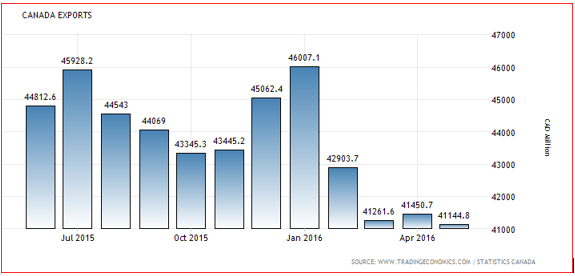

Beginning with the overall trade picture (Chart 1), we see that exports held up particularly well up to January 2016, but then fell sharply and remained weak. Much of the weakness is due to the fall in oil exports, and in Q2, the loss of additional oil exports due to the devastating forest fires in northern Alberta .

Chart 1 Canada Exports, 2015-2016 (May)

However, Canada`s merchandise trade balance continues record deficits (Chart 2). Of special note is the weakness in non-energy exports, much to the dismay of export industry. Peter Hall, chief economist at  Export Development Canada, lamented that it is counterintuitive. It is not what we were expecting to see at all. Recall that the Bank of Canada has pinned its recovery strategy on non-energy exports picking up most of the slack due to falling energy exports.