Market Summary

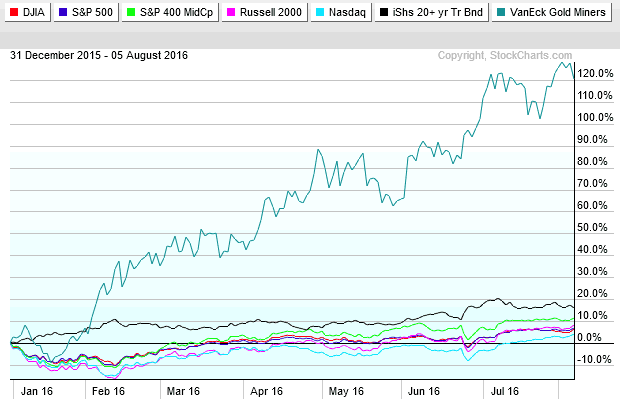

U.S. stocks notched their best day in a month on Friday, with the S&P 500 and Nasdaq closing at record highs after a second straight month of robust labor market data boosted optimism that U.S. economic growth is accelerating. The current momentum is providing a strong catalyst for the next leg higher. The S&P 500 notched its eighth closing high of the year, powered by gains in financial company stocks which would be primed for a profit boost should the Federal Reserve raise interest rates. For the week, the S&P 500 Index finished up a modest 0.4% and the Blue Chip-heavy Dow Jones Industrial Average rose 0.6%. The Nasdaq rose a solid 1.3% while the small cap Russell 2000 finished up 1%.

A tool to help confirm the overall market trend is the Bullish Percent Index (BPI). The Bullish Index is a popular market “breadth” indicator used to gauge the internal strength/weakness of the market. Like many of the technical market internal indicators, it is used both to confirm a move in the market and as a non-confirmation and therefore divergence indication. The uptrend line in the updated chart below supports recent analysis where we said, “…Nasdaq stocks are leading the market higher as quarterly earning numbers have enticed investors. Strength in technology and small cap stocks are primarily propping up the market. As long as the BPCOMPQ remains in an uptrend expect the overall stock market to remain near all-time highs…”

Last week we wrote “…. the DJ Industrials and Transports confirm a downtrend…” You can see in the updated chart below how the DOW Industrials and Transports reversed course and both are now trending higher to confirm the current bullish market move.

In the updated chart below, the dollar strengthened last week after the strong July jobs report was seen increasing the likelihood of a Federal Reserve interest-rate hike before the end of 2016. Treasury prices tumbled; pushing up yields after July’s stronger-than-expected jobs report was interpreted as potentially giving the Federal Reserve reason to raise interest rates. The move being most pronounced in short-term yields, which are most sensitive to changes in the Fed-funds rate and tend to spike when the market’s rate-hike expectations rise. Gold notched a hefty loss Friday, tumbling the most in about 2 1/2 months following the stronger-than-expected jobs report. Higher rates can boost the value of the dollar and undercut the appeal of commodities priced in the currency, making them more expensive for buyers using other monetary units. A rate hike also diminishes the appeal of owning gold, which does not offer a yield.