By ManiÂ

Even though many are hankering for an inflection point in the bond markets, HSBC analysts believe it’s too early to call a turning point, and there is plenty of evidence of policy exhaustion. Steven Major and colleagues said in their August 4 research piece titled “Fixed Income Asset Allocation: Hold your horses†that they remain bullish on EM rates, where improving domestic fundamentals continue to attract flows from DMs.

Japan’s real rates are extremely low

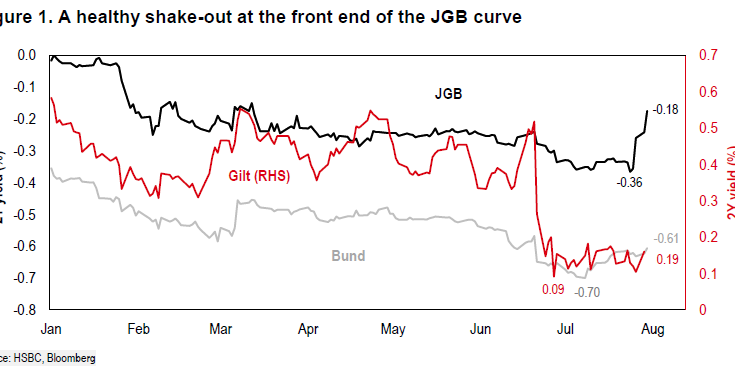

The HSBC analysts point out that the focus has shifted to Japan, where, despite all the policy efforts, forward real yields are exceptionally low for a reason. Though there has been some focus on policy fatigue in Japan, the analysts are not pushing their yield forecasts higher. They believe it’s too early to change the low rates view for Japan, though the BoJ’s failure to trim rates and an underwhelming response to the government’s fiscal package is the best explanation for the sharp back-up in JCB yields:

Major and colleagues point out that the situation has been worsened by overly zealous expectations of rate cuts, which, when combined with news of Ben Bernanke’s presence in Japan, may have resulted in expectations of even more unconventional policies. When the analysts look more closely at the forward curve shifts of the last five years, they note that JCB real yields stand out. Though higher inflation is an explicit objective of the BoJ, the analysts believe it has just not come through, either in actual printed inflation or in the forwards.

HSBC analysts look to buy dips in the U.S.

Focusing on the U.S. market, Major and team look for dips to buy in a choppy trading range. They note that 12-month projected returns for Treasuries and TIPS show significant carry/roll effects.

On Eurozone core, the HSBC analysts lowered their view to neutral from mildly bullish. They believe that funding pressure for Belgium is low, and it’s already raised 84% of 2016 funding. Within AAA- to AA-rated Eurozone sovereigns, they see value in buying 10-year Belgium against France: