The gold price has seen plenty of volatility this past week. But on a day-to-day basis, that volatility has been mostly to the upside.

From a macro perspective, we’ve seen ongoing supportive developments for gold prices.

Central banks continue to be accommodative, and negative rates are increasing in both intensity and range. We’ve now reached a point where a quarter of the world’s sovereign debt provides a negative yield.

And yet central banks keep buying bonds and pushing interest rates ever lower. If I had to point to a single bullish factor for the price of gold, negative interest rates would be it.

Of course, there are also geopolitical instabilities and security threats. The approaching U.S. presidential election – one of the most contested and divisive ever – is adding fuel to gold’s fire.

And from a technical perspective, both gold prices and gold stocks are looking quite strong.

We’ll delve into these factors and my 2016 gold price target. In fact, I see the metal returning another 11% by the end of the year.

First, here’s a recap of gold’s volatile performance this past week…

Why the Gold Price Moved Lower This Week

After posting a 1.4% gain last week, the price of gold kicked off this week with strength. On Monday, Aug. 1, prices opened lower but inched back up to close at $1,352 for a 0.1% gain.

Then Tuesday saw another advance. The price of gold pusher higher in early morning trading and gained 0.8% to settle at $1,363.

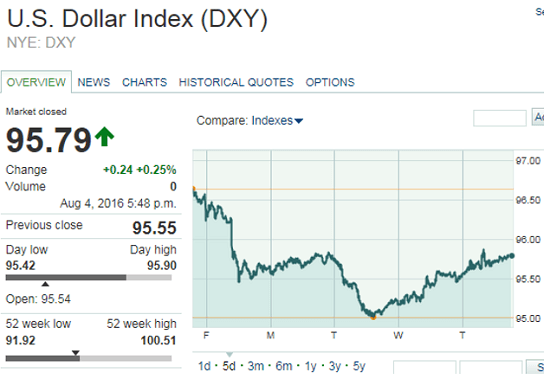

Here’s how the U.S. Dollar Index (DXY) has trended this week, which explains the recent gains in gold prices…

On Wednesday, Aug. 3, gold price weakness returned as the dollar regained the 95.50 level after bottoming near 95 on Tuesday. Gold lost 0.7% to close at $1,352.

Gold prices rose on Thursday after the Bank of England decided to cut rates for the first time since 2009. The bank lowered rates from 0.5% to 0.25%. Gold responded by rising to $1,364 at the open. By the end of the session, the price of gold had gained 1.1% to close at $1,367.