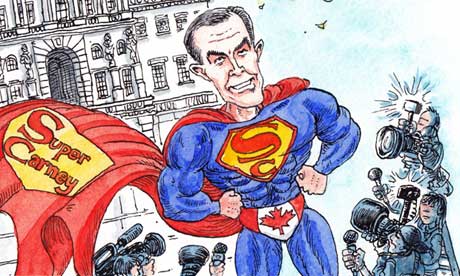

Mark Carney, Wrecking Ball

For reasons we cannot even begin to fathom, Mark Carney is considered a “superstar†among central bankers. Presumably this was one of the reasons why the British government helped him to execute a well-timed exit from the Bank of Canada by hiring him to head the Bank of England (well-timed because he disappeared from Canada with its bubble economy seemingly still intact, leaving his successor to take the blame).

This is how Mark Carney is seen by the press. A few decades ago no-one would have thought that the drab bureaucrats inhabiting central banks would ever get this much attention, and yet, here we are. It’s like living in a really bad B-movie.

Cartoon via theguardian.com

The adulation he receives is really a major head-scratcher. What has he ever done aside from operating the “Ctrl. Prnt.†buttons? As far as we are aware, nothing. As we have discussed previously, his main legacy is that he has left Canada with one of the greatest and scariest real estate and consumer credit bubbles extant in the world today. Some accomplishment!

With respect to his economic analysis, it seems not the least bit different from the neo-Keynesian/ semi-monetarist mumbo jumbo we get to hear from central bankers everywhere. This is by the way no surprise: they’re an incestuous bunch and have largely received their education at the same institutions.

Most of them seem genuinely convinced that central planning not only works, but is necessary to improve on the alleged drawbacks of an “unfettered market†(i.e., the mythical unhampered free market economy no-one alive today has ever experienced). If one looks closely at what they are actually doing, it soon becomes clear that it is in principle not much different from what John Law did in France in the early 18th century (the difference is one of degree only).

BoE Adopts Loosest Monetary Policy in History

The much-dreaded “Brexit†has now given Mr. Carney the opportunity to do what he does best, namely open the monetary spigots wide. One might as well try to improve one’s health by playing a few rounds of Russian roulette every morning before breakfast. Here is a summary of the measures the Bank of England announced last week (via Reuters):

The Bank of England cut interest rates to next to nothing on Thursday and unleashed billions of pounds of stimulus to cushion the economic shock from Britain’s vote to leave the European Union. Acting on its chief economist’s wish to use “a sledgehammer to crack a nutâ€, the BoE reduced interest rates by 25 basis points to a record-low 0.25 percent.

This first cut since 2009 was accompanied by a pledge to buy 60 billion pounds ($79 billion) of government bonds with newly created money over the next six months, and two new stimulus schemes. One will buy 10 billion pounds of high-grade corporate debt, the other – potentially worth up to 100 billion pounds – is to ensure banks pass on the full rate cut to borrowers. The Bank said most BoE policymakers expected to cut the main interest rate to even closer to zero later this year, and sharply downgraded its outlook for growth next year.

“By acting early and comprehensively, the (Bank) can reduce uncertainty, bolster confidence, blunt the slowdown and support the necessary adjustments in the UK economy,†BoE Governor Mark Carney told a news conference.

Sterling fell as much as 1.6 percent against the dollar following the announcement, while British government bond yields hit record lows and the main share index rose by 1.6 percent.

Carney said he had unveiled an “exceptional package of measures†because the economic outlook had changed markedly following the Brexit vote. The Bank expects the economy to stagnate for the rest of 2016 and suffer weak growth next year. By cutting rates to the lowest in its 322-year history, the BoE joins the Bank of Japan and the Reserve Bank of Australia, which both undertook unprecedented stimulus in the past week.

Finance minister Philip Hammond welcomed the rate cut and said he and Carney had “the tools we need to support the economy as we begin this new chapter and address the challenges aheadâ€.