“The financial sector moves with interest rates. It is poised to benefit from rising interest rates and will be punished should rates continue to fall.â€Â – Investing Folklore

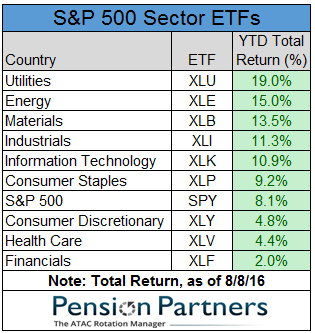

Long-term interest rates have fallen sharply in 2016, the yield curve has flattened, and Financials are the worst performing sector in the S&P 500.

Â

Coincidence? Most would say no, as the standard talking points are that higher rates and a steeper yield curve are “good†for Financials while the opposite conditions are the bane of their existence.

But how accurate are these statements? Are they rooted in fact or folklore?

Let’s take a look at the historical data.

Going back to 1990, the monthly correlation between the S&P 500 Financials sector and the U.S. 10-Year Treasury Yield is .04. What does this mean in plain English? There is no consistent relationship between Financials and yields over the past 26+ years.

Â

While there certainly have been many years where Financials and U.S. yields have moved in the same direction (2005 through 2009), there are also many years where they have moved in opposite directions (1990 through 1995). In fact, going back in 1990, they have actually moved in opposite directions more often (56% of years).

Â

What about the U.S. Yield Curve (10-Year yield minus 2-Year yield)? Surely there’s a strong relationship there, right?

No. The monthly correlation since 1990 is .01.

Â

(Note: for our research on Treasury bonds, click here).

Similar to the 10-year yield, we actually find that there were more years (56%) in which the yield curve moved in the opposite direction to Financials.

Â

Thus far we have only looked at Financials on an absolute basis. Perhaps on a relative basis (performance vs. the S&P 500) there exists a stronger relationship with yields/yield curve. Are Financials more likely to outperform when yields are rising and more likely to underperform when yields are falling?