The referendum that punted the UK out of the European Union (EU), “Brexitâ€, is practically a forgotten memory for most people outside of Europe. For example, the aftermath of this vote now looks like an event that quickly shook out the most eager sellers in the stock market and thus paved a course for a fresh rally.

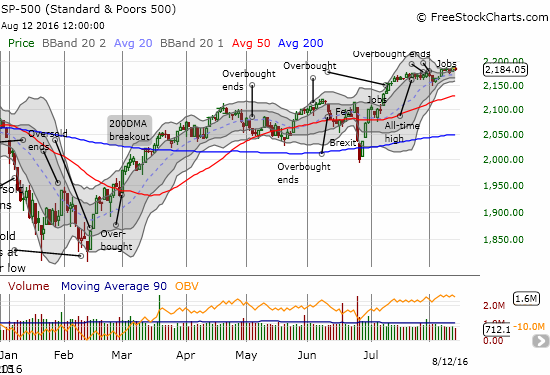

The S&P 500 (SPY) made a sharp and rapid recovery from a 2-day post-Brexit loss and went on to set new all-time highs.

Source:Â FreeStockCharts.com

On Friday, an email from ditech, a financial institution, brought a fresh reprise of lessons from Brexit. The email pointed to a blog post dated June 28, 2016 that dripped with excitement in the enticing title “Brexit Brings Low Rates!†The post summed up well the rosier perspective on the post-Brexit world as one of opportunity rather than one of crisis. For example, Ditech applauded the near historic impact on mortgage rates:

“Friday, June 24th, saw mortgage rates drop a full eighth of a point. And while this might not sound like a lot, it marks only the ninth time in a decade when rates have moved this much in a single day, with the most recent occurrence in October 2014. According to Matthew Graham, reporter for Mortgage News Daily, ‘it’s the single best day for mortgage rates in more than a year, not to mention the fact that outright levels are getting very close to all-time lows.’â€

Shorter-term rates have nearly recovered all their post-Brexit losses. Longer-term rates, which drive mortgage rates, have yet to fully recover.

Source: Board of Governors of the Federal Reserve System (US), 1-Year Treasury Constant Maturity Rate [DGS1], retrieved from FRED, Federal Reserve Bank of St. Louis, August 13, 2016.

Lower rates mean greater opportunities – refinance or even buy a home. Let the world’s fears transform into the U.S.’s cheers…

“While the headlines report on the volatility of the financial markets world wide, remember that the U.S. economy remains fundamentally sound. This global unease, as reported in Forbes, has a silver lining for U.S. homebuyers looking to purchase and home owners looking to refinance —cheap loans…

Of course, if you’re a home owner with a mortgage, you should consider refinancing. Lock if you like what you see. If you don’t have a mortgage, why not take advantage of these low rates to purchase your first home, your retirement home, your second home, your vacation home, or that rental property you’ve been considering.â€

Imagine – who would have thought to market a burst of global angst as a great time to buy a home!?

Even better, Brexit presumably forced the Federal Reserve to be even more cautious than it might otherwise have been. Rates should now stay lower for longer…

“Joe Bilko, Vice President of Capital Markets for ditech…’Following the Brexit outcome of the UK referendum, rates reached three year lows. We would expect rates to remain lower for longer as the Federal Reserve weighs changing global political and growth outlooks when making future rate decisions.’â€

In other words, Brexit’s crisis of confidence has benefited borrowers and the indebted.

This outcome now repeats a well-worn pattern and cycle since the Great Recession. As each financial crisis or setback blows through the global economy, the debris eventually coalesces into ever higher asset prices supported by lower rates, more accommodative monetary policies, and/or weaker currencies in key markets used for leveraging into higher yielding investments. The FTSE 100, a UK index of the country’s largest companies, was just such an early winner.

The FTSE 100 sold off for two days in the wake of Brexit. In two more days, the big cap index closed above its last pre-Brexit close. It now trades at 14-month highs.

Source:Â FreeStockCharts.com

A U.S. stock market sitting at all-time highs (the S&P 500, Nasdaq, and the Dow just closed at all-time highs together for the first time since 1999) serves as a reminder that each dip, every crisis, all periods of angst, have provided buying opportunities. The special feature of the post-Brexit angst was that it only lasted two days and did not even produce follow-on spasms in the recovery period. The comforting assurances and interventions of central banks are becoming ever more effective for financial markets!

For more context, I review the alarming reactions in the immediate wake of Brexit. Everyone “knew†that a vote in favor of Brexit would cause trouble based on warnings from just about every respected major financial institution on the planet. The follow-on rush to reassure global markets was an immediate and palpable reminder that something serious had indeed happened. Even Alan Greenspan, former chair of the Federal Reserve three regimes ago (1987-2006), helped to amplify the alarm bells.

When Greenspan gets airtime, you KNOW someone in the media thinks a historic moment is at hand!

Greenspan claimed that the fallout form Brexit was just the tip of the iceberg. He referenced renewed calls for Scottish independence and restricted movement between Northern and Southern Ireland. More importantly, Greenspan noted that Brexit reflects a more fundamental problem of slowing incomes across the “whole European spectrumâ€, the United States, and for that matter the entire OECD (The Organisation for Economic Co-operation and Development). Stagnant real incomes are creating political problems like Brexit. Greenspan went on to explain that the euro (FXE) itself is in trouble with Greece likely to drop out.