(T2108 measures the percentage of stocks trading above their respective 40-day moving averages [DMAs]. It helps to identify extremes in market sentiment that are likely to reverse. To learn more about it, see my T2108 Resource Page. You can follow real-time T2108 commentary on twitter using the #T2108 hashtag. T2108-related trades and other trades are occasionally posted on twitter using the #120trade hashtag. T2107 measures the percentage of stocks trading above their respective 200DMAs)

T2108 Status: 67.1%

T2107 Status: 72.9%

VIX Status: 11.56 (2-year low)

General (Short-term) Trading Call: neutral

Active T2108 periods: Day #127 over 20%, Day #33 over 30%, Day #32 over 40%, Day #31 over 50%, Day #8 over 60% (overperiod), Day #10 under 70%

Commentary

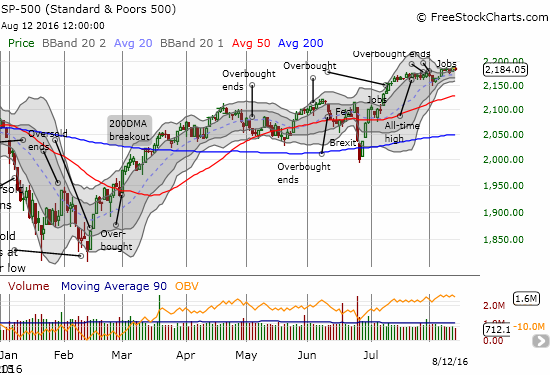

Last week was a week of boring all-time highs. After the previous Friday’s all-time high, the S&P 500 (SPY) made two new intraday highs and one new closing high. The new closing high came on a day when all three major indices – the S&P 500, the Nasdaq (QQQ), and the Down Jones Industrials (DIA) – hit new all-time highs on the same day for the first time since 1999 (at least Nightly Business Report made that observation). Yet, the S&P 500 barely gained a point for the week.

The S&P 500 is up 1.4% over the past month which has printed several new all-time highs.

The Nasdaq joins the S&P 500 at all-time highs.

Despite the new all-time highs, T2108, the percentage of stocks trading above their respective 40-day moving averages (DMAs), has yet to return to overbought status. It was last overbought on July 29th for a brief 1-day overbought period. This divergence is not dramatic, but it DOES have my attention given I am already wary about the extremely low level of the volatility index, the VIX, during a period prone to big drawdowns.

The volatility index, the VIX, recently managed to push even further into two-year lows.