Introduction

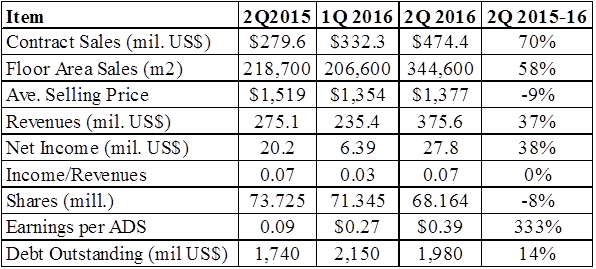

The second quarter results from Xinyuan (XIN) sound good. Table 1 summarizes data from CFO Liu’s statement at the earnings call. Sales are up. Area sales are up but not by as much (possibly because a greater portion of more expensive properties sold). Selling prices are holding up and Koneko Research has reported primarily favorably on prices where XIN has properties. Revenues and profits are growing steadily. And in part a result of share buybacks, earnings per ADS have also jumped.

Table 1. – XIN Second Quarter Results

Source:Â XIN

So overall, things look good. But the devil is in the details that I cover below.

Dividends and Buybacks

XIN has definitely made many US investors happy by its dividend doubling (from 5 cents per quarter to 10 cents) and via its buyback actions. The dividend jump means the annual yield has increased to 6% based on XIN’s $6 price. And with 68,164 ADS outstanding, this quarterly dividend payment of $6.82 million is at what should be a sustainable payout ratio (6.82/27.8) = 24%.

XIN bought back 9 million shares in 2014, 1.1 million shares in 2016 and another 1.4 million shares this quarter. That means that since the end of 2013, XIN has reduced the shares outstanding by 14%.

The dividend increase and buybacks coupled with good performance, should be enough to attract more investors and cause the stock price to rise. But it comes at a cost: the funds required for the dividend jump and buybacks in the second quarter cost approximately $14 million. And that is $14 million not available for real estate development.

Real Estate Development is a Risky Business

A quick aside on real estate development: we know that real estate prices go up and down and it is risky/tricky to predict the future. But there is another part of real estate development that also makes it risky – the time phasing of activities. Developers have to:

- identify properties to develop,

- raise money,

- get approvals to build,

- building

- sell and

- phase cash flows in a way to have funds when needed.