As part of its quarterly Flow of Funds update, earlier today the Fed released snapshot of the US “household” sector as of June 30. What it revealed is that with $103.8 trillion in assets and a modest $14.7 trillion in liabilities, the net worth of the average US household rose to a new all time high of $89.1 trillion, up $1.1 trillion as a result of an estimated $474 billion increase in real estate values, and mostly $750 billion increase in various stock-market linked financial assets like corporate equities, mutual and pension funds.

Household borrowing rose at a 4.4% annual rate, with total household liabilities grew growing by $200 billion from $14.5 trillion to $14.7 trillion, the bulk of which was $9.6 trillion in home mortgages.

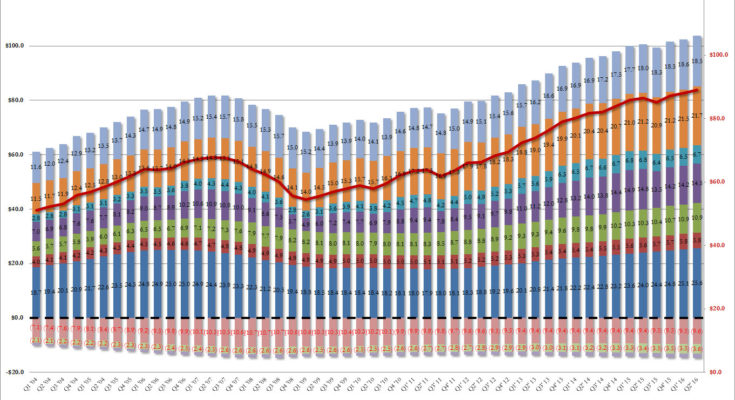

The breakdown of the total household balance sheet as of Q2 is shown below.

(Click on image to enlarge)

And while it would be great news if wealth across America had indeed risen as much as the chart above shows, the reality is that there is a big catch: as shown previously, virtually all of the net worth, and associated increase thereof, has only benefited a handful of the wealthiest Americans.

As a reminder, from the CBO’s latest Trends in Family Wealth analysis, here is a breakdown of the above chart by wealth group, which sadly shows how the “average” American wealth is anything but.

(Click on image to enlarge)

While the breakdown has not caught up with the latest data, it provides an indicative snapshot of who benefits. Here is how the CBO recently explained the wealth is distributed:

- In 2013, families in the top 10 percent of the wealth distribution held 76 percent of all family wealth, families in the 51st to the 90th percentiles held 23 percent, and those in the bottom half of the distribution held 1 percent.

- Average wealth was about $4 million for families in the top 10 percent of the wealth distribution, $316,000 for families in the 51st to 90th percentiles, and $36,000 for families in the 26th to 50th percentiles. On average, families at or below the 25th percentile were $13,000 in debt.