The dollar started the European session weakening, resulting in the EUR/USD pair jumping up to 1.1213, as once again, local share markets opened with a strong note. Still, the pair seems unable to hold gains above the 1.1200 region, and quickly retreated afterwards, holding however in the green daily basis. The movements are still shallow across the board, as investors are waiting for the US Federal Reserve and the Bank of Japan both set to release their latest economic policy decisions during the upcoming 48 hours.

In the data front, Germany released its August PPI figures, down by 1.6% compared with the corresponding month of the preceding year, below market’s expectations of -1.5% but above previous -2.0%. Compared to July, the index fell by 0.1% against expectations of 0.0%. Later on today, the US will release its August Housing Starts and Building Permits, expected generally better than in July.

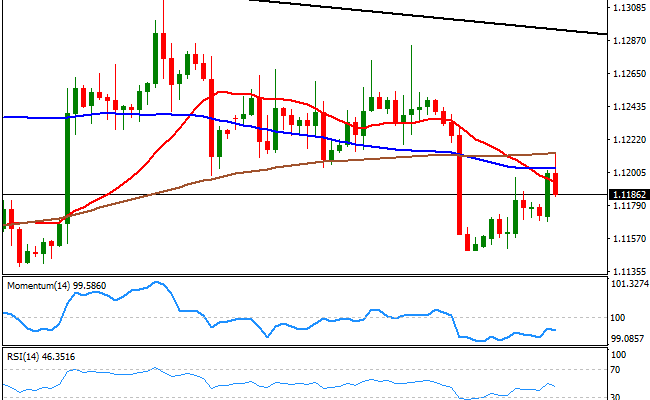

In the meantime, the 4 hours chart for the EUR/USD pair shows that it is trading around 1.1185, and that the intraday advanced stalled right at the 200 SMA, and is back trading below all of its moving averages that anyway remain in a tight range. The 20 SMA maintains its bearish slope, indicating that the risk is towards the downside in the short term. Technical indicators support this latest view, having turned lower within bearish territory.

The immediate support comes at 1.1150, with a downward acceleration below it targeting 1.1120, August 31st daily low. Above the mentioned daily high on the other hand, the recovery can extend up to 1.1245 today.