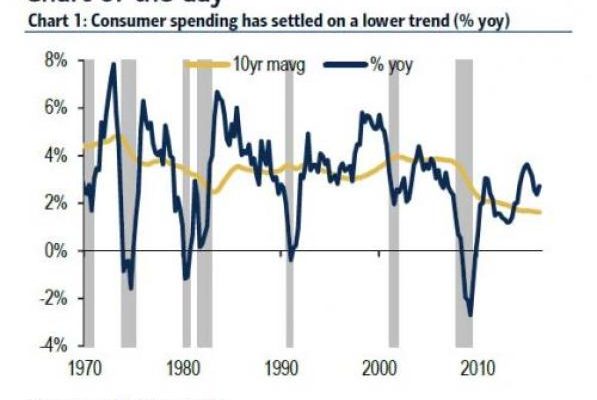

One of larger banks to have undergone a substantial downshift in its outlook on the market and the economy, is Bank of America (BAC), which continued the dour mood this morning when in note by its economist Ethan Harris it again pointed out that US consumer spending has “settled at a lower trend.â€

Here are the details:

Consumer spending has settled on a lower trend: Consider these three facts: (1) household wealth is nearly back to peaks during the housing bubble as a percentage of disposable income; (2) interest rates are at historical lows; and (3) initial jobless claims have touched the lowest level since 1973. That looks like a recipe for spectacular consumer spending. But, yet, real consumer spending has only averaged a 2.0% annual rate since the recovery started, which is nearly half the pace of the prior 10-year average. What happened? The recovery in wages has been slow and the savings rate has increased. The 4-quarter moving average of the personal savings rate (derived as disposable income less outlays) has reached 5.9% over the last two quarters. An alternative measure of the savings rate, which is measured from household net worth, has seen even more impressive gains. As we argue, the savings rate is likely to remain elevated, limiting the potential upside to consumer spending due to a variety of cyclical and structural reasons.

While spending has declined, savings – that bogeyman of Keynesian economics – continue to rise. As BofA writes, there is a long list of reasons for consumer spending to have undershot the growth in disposable income, boosting the savings rate.

The bank addressed the top theories, starting with the cyclical factors (that are potentially reversible) and ending with the structural.

- Household deleveraging, which partly reflects constraints in accessing credit.

- Reduced expectations for future real income growth given stubbornly slow wage growth and departures from the labor market.

- Concern about future entitlements and social safety nets given the unfavorable outlook for the US deficit.

- Greater income and wealth inequality, with a larger share of money going to the population with a greater tendency to save.

- An aging population, which increases the share of the population focused on building up retirement savings.