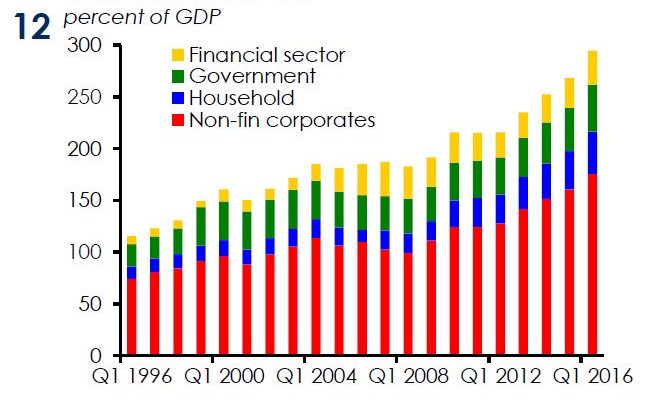

By now it is widely accepted that the biggest credit risk facing the global financial system is not so much among western banks, which have been closely scrutinized, and their balance sheets are largely exposed to both regulators and the public (perhaps with a few notable exceptions) but are arising from China. And while China’s total leverage, by most counts, is somewhere in the 300% range, according to the IFF…

(Click on image to enlarge)

… and modestly lower according to other sources, the real worry is not so much the sovereign or corporate non-financial debt within China, but the leverage within its opaque, murky financial system.

What we do know about China’s banks is what the government discloses, which is not much, however overnight China’s Banking Regulatory Commission reported on its website the latest amount of total domestic assets on China’s bank books: as of September the number is a stunning CNY217.3 trillion, or just over $32 trillion. On a year over year basis, this series grew at a whopping 14.7% in September, more than double the rate of growth of China’s overall economy, and suggesting that something is truly broken in China’s credit transmission mechanism.

(Click on image to enlarge)

As for bank liabilities, or loans and other even murkier obligations, the Chinese regulators reported that this number had grown even faster, by 15.5%, and has for the first time ever surpassed 200 trillion yuan – just shy of USD $30 trillion – for the first time, and hitting CNY200.4 trillion as of September 30. By comparison, total US bank liabilities are roughly half this number.Â

(Click on image to enlarge)

Normally we would end with something cynical or witty to add, alas when looking at this massive number, of which by rough estimates somewhere between 15% and 20% is in the form of bad loans, there is nothing witty, or even cynical, to be added.Â