The euro enjoys safe haven flows and advances against the dollar and against other currencies. Can the common currency turn south?

Here is their view, courtesy of eFXnews:

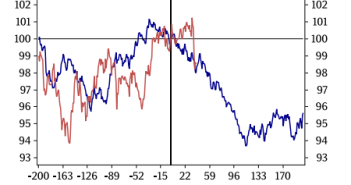

Traditionally the dollar has weakened in trade-weighted terms and against the euro after the first rate hike by the Fed in every new hiking cycle since the 1990’s.

Although there were reasons suggesting things might be different this time the recent depreciation of the dollar, triggered by falling risk appetite, is not that unusual after all. This time it happened because the euro was turned into a funding currency.

Therefore, if market risk appetite continues to fall EUR/USD will probably move even higher in the near term, which would reflect the normal behaviour following the Fed liftoff. Although it could take some time we expect EUR/USD to eventually move lower from current levels. But it probably takes shift in Fed expectations towards further rate hikes this year and a trigger that improves market risk sentiment.

Although it may appear as a large move, we still view parity in the currency pair as a possibility but this extreme is no longer reflected in the forecast.

Nevertheless by the end of 02 we expect EUR/USO to trade towards 1.05.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.