Asian stocks, S&P futures and European shares trade flat as a tightening race for the U.S. presidency spurs demand for haven assets including the yen while weighing on stocks and Mexico’s peso. A turbulent overnight session saw some early risk off following the plunge in Facebook (FB) shares and the Fox News report that an FBI probe into the Clinton foundation may lead to a “likely indictment.”

More recently, news out of the UK, where a High Court ruled against the government, that an Article 50 Vote would need approval from government, sent sterling surging and provided a modest impetus to risk assets. Still, as Bloomberg notes, investors are becoming increasingly “jittery” on the heels of Trump’s recent upward momentum.Egypt’s currency tumbled as the country switched to a freely floating exchange rate.

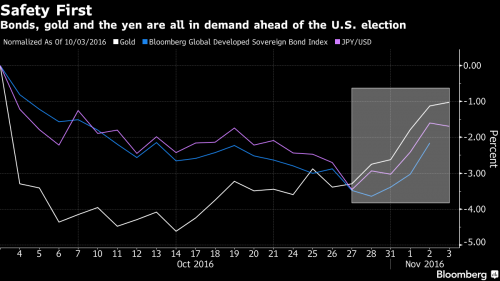

The yen climbed to a one-month high, U.S. equity index futures fell and the MSCI All Country World Index held near its lowest since July after Fox News reported that a Federal Bureau of Investigation probe involving Democratic nominee Hillary Clinton was intensifying. The peso weakened versus all major peers on concern Mexican exports will suffer if she loses, while Bloomberg’s dollar index dropped for a fifth day amid speculation the election’s fallout could deter the Federal Reserve from raising interest rates. Gold gained.

As observed by the longest losing stretch in US equities since 2011, investors have turned more risk averse over the past week as voter surveys suggested Clinton’s once dominant lead over Donald Trump was faltering ahead of the Nov. 8 election. Bets on a December interest-rate hike by the Fed were stepped up on Wednesday at the central bank left policy unchanged and signaled a December move was likely.

“U.S. political uncertainty ahead of next week’s election is weighing on markets,†said Elias Haddad, a senior currency strategist at Commonwealth Bank of Australia in Sydney. “Most polls suggest the presidential election is turning out to be a closer call now compared to a few days ago following the controversy about Hillary Clinton’s e-mail investigation. In the short term, this should weigh on the dollar particularly versus the yen and euro.â€

The FBI’s investigation into Clinton has taken on a very high priority, Fox News reported, citing unidentified sources. She led Trump 39 percent to 35 percent among independents surveyed Friday through Monday, the latest Purple Slice online poll for Bloomberg Politics showed.

Futures on the S&P 500 Index fell 0.1% following a seventh day of losses in the U.S. benchmark, its longest selloff since November 2011, although it rebounded from overnight lows. Nasdaq 100 Index contracts declined 0.3 percent after Facebook Inc. slid in extended New York trading after reporting earnings. The social network predicted an uptick in costs and a slowdown in advertising sales growth.

The Stoxx Europe 600 Index fluctuated following an eight-day losing streak. Credit Suisse Group AG fell 3.9 percent after reporting earnings, while ING Groep NV gained 3.6 percent and Societe Generale SA surged 4.8 percent.

Asia ex-Japan stocks held near their lowest level since September after sliding 1.4 percent in the last session. New Zealand’s benchmark stock gauge entered a correction, while Japanese markets were shut for a holiday. Hong Kong’s Hang Seng Index slipped to its lowest level since August and Wynn Macau Ltd. dropped by the most since August after reporting a profit that trailed analysts’ estimates. “The move to take risk off the table continues,†Chris Weston, chief market strategist in Melbourne at IG Ltd., said in an e-mail to clients. “We have reached a point where there is a buyers strike, where money managers have reduced their risk, increased cash allocations within the portfolio and are happy to ride out this mini-storm of uncertainty.â€

The yield on 10Y U.S. Treasuries was little changed at a one-week low of 1.80% .

* * *

Bulletin Headline Summary from RanSquawk

- European equities trade lower amid the latest US election polls showing further gains for Trump

- Article 50 court ruling: Government cannot trigger article 50 without approval from parliament. However, the government will appeal this decision at the Supreme Court

- Looking ahead, highlights include BoE QIR, US Non-ISM, Services, and Factory orders

Market Snapshot

- S&P 500 futures down than 0.1% to 2091

- Stoxx 600 up 0.2% to 332

- MSCI Asia Pacific down less than 0.1% to 138

- US 10-yr yield down less than 1bp to 1.8%

- Dollar Index down 0.14% to 97.26

- WTI Crude futures up 0.6% to $45.62

- Brent Futures up 0.9% to $47.27

- Gold spot down 0.2% to $1,294

- Silver spot down 1.4% to $18.22

Global Headline News

- U.K. Government Loses Lawsuit Over Article 50 Vote

- Credit Suisse Drops as One-Time Gain Fuels Third-Quarter Profit: CEO Thiam says outlook to remain challenging for Swiss bank

- Schroders Assets Reach Record Boosted by Sterling’s Weakness: 2 billion pounds ($2.47 billion) of net inflows in the third quarter, as investors put money back to work in the aftermath of the Brexit vote

- Shire and Sobi Rally as Roche Has Adverse Hemophilia Drug Events

- Corporate-Bond Tech Firm Starts Trading Platform With Euronext: Despite many new platforms, trading is largely bank-dominated

- Lenovo’s Quarterly Profit Tops Estimates on Sale of Assets: Booked a gain of more than $200 million from property sales

- Air France Plans New Long-Haul Arm as Janaillac Takes Charge: Incoming CEO reveals troubled carrier’s new strategic plan

- Cantor’s Prop Traders See Big Profits in PDVSA Distressed IOUs: Company has issued promissory notes to oil-services suppliers

- BlackRock Says India Tops List as It Expands Private Credit: Banks’ retreat under pressure has created gaps for funds

- Amazon (AMZN) Said to Consider Bid for Stake in Dubai’s Souq.com: Stake sale may also draw interest from private equity firms

- Lockheed F-35 Needs $530 Million More for Development Phase: Pentagon officials says funds to be requested in next budget