US Index futures, European and Asian shares surged most in weeks after the FBI cleared Hillary Clinton one last time of her handling of emails as secretary of state which it repeated wasn’t a crime. Oil, gas rise, together with most industrial metals; the VIX, yen and Swiss franc retreated with gold, silver and other flight to safety assets.

The FBI news lifted a cloud over Clinton’s presidential campaign two days before the U.S. election and put Wall Street firmly on track to snap a nine-day losing streak – its longest in more than 35 years.

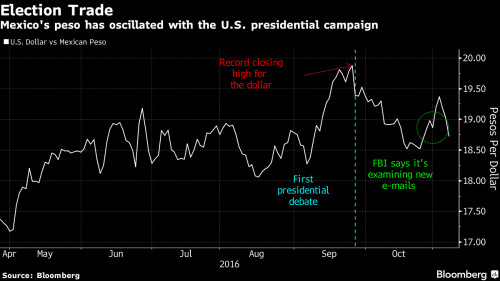

The US public and global markets were stunned for the second time in two weeks by the FBI, when James Comey announced in a letter to Congress just after 3pm on Sunday the Bureau was sticking with its view that Clinton’s handling of e-mails during her tenure as secretary of state wasn’t a crime, after reviewing new communications potentially related to the Democratic candidate. Comey’s announcement just over a week earlier that the bureau was looking into more e-mails sparked a selloff in risk assets, with U.S. stocks capping their longest run of losses since 1980. The peso’s fortunes have been tied to Trump’s campaign given his pledge to renegotiate trade deals with Mexico and to build a wall along the U.S. border, Bloomberg reminds us.

According to a snap assessment by Deutsche Bank, with the election still largely in the margin of error, “a Clinton victory would be most likely to maintain the status quo policy wise and as our US fixed income strategists point out most likely to continue with financial repression tactics. We would probably have a short-term rally in risk and yields would spike a bit higher under this scenario. However could she get much fiscal stimulus through? If not this would cap the rise in yields. A Trump win is more likely to bring higher fiscal stimulus and an easing of financial repression. The uncertainly of what his policies would mean and the fact that financial repression is good for assets (all other things being equal) will probably mean a short-term risk asset sell-off. The scale and effectiveness of the possible fiscal stimulus would then play a big part in dictating risk assets over the medium term. The range of outcomes for asset prices and the economy (bad and good) are much higher with Trump.”

Many of the safe-haven assets that had performed so strongly last week when polls showed Republican candidate Donald Trump closing the gap turned the other way. Gold, bonds and the Swiss franc all fell on Monday.

“Markets are pricing in a win for Clinton,” said Kathleen Brooks, Research Director at City Index. “If Clinton wins we could see a continued recovery in risky assets like stocks and the Mexican peso. There could be another sell-off in gold and U.S. Treasuries, pushing up bond yields, which could also be dollar-positive.”

Among the biggest movers, the Bloomberg Dollar Spot Index rose for the first time in seven days on optimism the FBI’s latest statement will make a Clinton presidency more likely and pave the way for the Federal Reserve to raise interest rates in December. Crude oil rose 1.3 percent to $44.64 a barrel in New York after Algeria’s energy minister said he remains confident the Organization of Petroleum Exporting Countries will set output quotas at its next meeting to manage production.

Gold fell as much as 1.3% to $1,288.11 an ounce. It surged 2.3 percent last week amid concern Republican Donald Trump may capture the White House, with Citigroup Inc. predicting a rally to $1,400 if he were to win.Â

The VIX index posted its biggest one-day fall in over four months. That followed a record stretch of nine consecutive daily increases.

In the latest US election news, FBI Director Comey vindicated Clinton in the latest email scandal over the weekend – leaving Clinton in a stronger position with just two days to go until the crucial vote. The USD strengthened and equities were bid overnight — MXN gained over 2% against the USD following the release — with downside observed in spot gold and fixed income. Further polls were released over the weekend, however, many now say that these could be out-of-date given the recent revelations with the FBI investigation.

Mexico’s currency, which rises when Republican presidential candidate Donald Trump’s campaign has a setback, was set for its biggest jump since September ahead of Tuesday’s U.S. presidential election. European equities rebounded from a four-month low and Asian equities rose with S&P 500 Index futures. The yen sank by the most in two months, U.S. Treasuries fell and gold dropped for the first time in eight days as investors shunned haven assets. Hong Kong’s property developers tumbled amid a surge in taxes on housing transactions, while nickel led a rally among industrial metals.

“The market is viewing the latest Hillary Clinton news as a positive, at least in the short term,†said Richard Sichel, chief investment officer at Philadelphia Trust Co., which oversees $2 billion. “It may still be a close call in the end, but the market for the time being is acting as if some of the uncertainty is gone.â€

Global stocks greeted the FBI announcement with a sigh of relieg, as the Stoxx Europe 600 Index jumped 1.2%, rebounding from its biggest weekly slide since February. In separate news, Euro-area finance ministers meet Monday to discuss banking union and Greece’s second bailout and European Central Bank Vice President Vitor Constancio may touch on monetary policy in a speech.

The MSCI Asia Pacific Index added 0.5 percent, after sliding 1.4 percent last week. Japan’s Topix index gained 1.2 percent as the yen’s retreat

gave a boost to the nation’s exporters. New Zealand’s benchmark stock gauge jumped by the most in five years. Westpac Banking Corp. led gains

among Australian banks after reporting earnings and HSBC Holdings Plc rallied by the most in two months in Hong Kong following its results. The Hang Seng Property Index of property shares was headed for its biggest loss in more than a year after the government raised stamp duty on home purchases, meaning foreign buyers will now pay an effective 30 percent. Cheung Kong Property Holdings Ltd. and Sun Hung Kai Properties Ltd. tumbled more than 8 percent.

S&P 500 futures rallied 1.3 percent following a nine-day slide in the underlying benchmark. The CBOE S&P 500 Volatility Index, a gauge of expected swings in U.S. stocks, soared 39 percent last week as Clinton’s lead was cut. While the race has tightened, the Democratic nominee maintains a 2.2 percentage-point lead over Trump, according to an average of polls by RealClearPolitics.

“All that drama and yet the FBI director is sticking to the same conclusion that they had in July with respect to Hillary Clinton’s e-mail,†said Naeem Aslam, chief market analyst at Think Markets U.K. Ltd. in London. “This is good news for investors who have an appetite for risk in this environment.â€

The yield on 10Y Treasuries rose by 4bps to 1.82% as Clinton’s improved election prospects were seen boosting the likelihood of a Fed rate hike next month. Similar-maturity sovereign bonds retreated across most of the developed world. If Clinton wins, “interest rates are likely to head higher as the market looks towards Fed normalization,†said Eugene Leow, a fixed-income strategist at DBS Group Holdings Ltd. in Singapore. “Conversely, sentiment is likely to deteriorate further if Trump wins. We suspect that the knee-jerk reaction lower in yields would be comparable to what was seen in the immediate aftermath of Brexit.â€