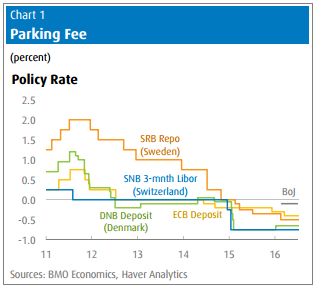

The central banks of five developed countries have all adopted negative interest rates (NIRP). The five countries are Switzerland, Denmark, Sweden, the Euro Area, and Japan. As a recent BMO report observes, Denmark has had negative rates for about five years, while Japan only recently adopted negative rates.

The general purpose of negative rates is to improve economic growth and to raise the pace of inflation. Most of these countries that adopted negative rates did so after six years of a painfully slow economic recovery from the Great Recession.

Negative rates are supposed to encourage the private banks to lend or invest rather than park their excess funds at the central bank. As such, bank funds earning negative rates are clearly losing money. In order for negative rates to work, it is also important to recreate a positive sloping yield curve in an environment of unusually low, longer term yields.Â

Why and how should negative rates work? Central banks typically pay some interest on commercial banks’ excess reserves (i.e. reserves above the minimum level) which are deposited at the central bank.

During normal times, banks usually minimize holdings in such excess reserves, because central bank deposit rates are usually below money market rates. However, since the global financial crisis, and with money market interest rates at very low levels, some banks have chosen to hold higher balances at central banks.

These banks have been holding excess reserves because of heightened risk aversion, and because the opportunity costs of hoarding reserves from profitable lending has been quite low, given the low returns on assets due to the sluggish economy.

In other words, it is rather unprecedented that the central banks shown in the following chart are now charging (instead of paying) commercial banks for their excess reserves.