The day has finally arrived and as of minutes ago voters in eastern states have begun voting for the next US president. Polls are open in eight states, including battlegrounds Virginia and New Hampshire, as well as in New York, where Clinton votes at a public school in Chappaqua, Trump at a public school in Manhattan.

Wow 80+ voters lined up early to cast their ballots #ElectionDay #PS59 #Manhattan where @realDonaldTrump will be voting also #NBC4NY pic.twitter.com/K8JUf1kv8h

— Katherine Creag (@katcreag4NY) November 8, 2016

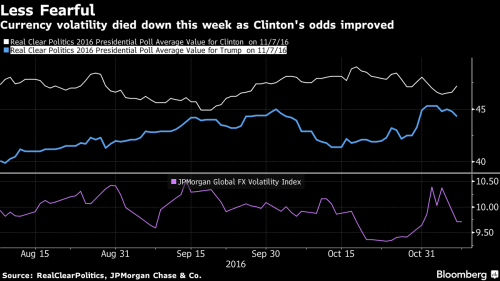

To celebrate, European, Asian shares rise as exchange-rate volatility dies down in the final hours before the U.S. presidential election; S&P 500 index futures fall; oil, gold, silver rise, nickel climbs to one-year high.

RealClearPolitics poll of polls gives Clinton the edge by 3.4% so she is firm(ish) favourite and the FBI news on Sunday night that they have found nothing incriminating in their additional enquiries may give her an additional boost given that Trump seemingly got a boost when they discussed re-opening the case 11 days ago. However in the Brexit poll, which was seen as a similar establishment vs. anti-establishment vote, the last 6 polls showed the stay vote average 51.7% against 48.3% leave (excluding don’t knows) – also a lead of 3.4%. The actually result saw the leave vote win with 51.9% of the vote and a winning margin of 3.8%. So when the numbers are as close as this and when we are seeing an anti-establishment movement that perhaps behaves differently to traditional election voters then the outcome is more uncertain, according to DB’s Jim Reid.

Logistics wise, if we use the 2012 election as a roadmap then the election result was called at 11.38pm EST Tuesday night. Unsurprisingly, determining when we will actually know the outcome really comes down to how quickly the states get their counts done and whether or not those states are in play. As an example, Kentucky and Vermont were called within 5 minutes of polls closing in 2012 but it took 3 days for Florida to be called. Ohio also took nearly 4 hours. In any case, the first polls close at 6pm EST/11pm GMT with results announced from then on. Some of the significant and closer-run state closing times which are worth watching out for include Virginia (7pm EST/12am GMT), North Carolina and Ohio (7.30pm EST/12.30am GMT), Pennsylvania (8pm EST/1am GMT), Colorado (9pm EST/2am GMT), Iowa and and Nevada (10pm EST/3am GMT). The drama should be over by the time Alaska closes (1am EST/6am GMT) but you never know.

For those scoring hole by hole, then as is the tradition, the tiny New Hampshire town of Dixville has already called with Clinton winning by a 4-2 margin over Trump. Apparently an 8th voter was added to the electoral roll at close to midnight which caused some late drama in the town and so just missing their one-minute past midnight call!

The good news is that all those companies who have complained that consumers aren’t buying their products and services due to election uncertainty should see an influx of willing buyers; the bad news is that there are no more excuses if they don’t.

For global markets, today was greeted with more buying of risk assets on the back of yesterday surge in the US stock market, which has been The MSCI All Country World Index extend the last session’s rebound from a three-month low, with European and Asian shares advancing. A gauge of expected exchange-rate swings held at a one-week low and the won was the best performer among major currencies, a sign of investors’ confidence by the market that Trump’s protectionist trade policies will be rejected in the vote, unless of course another “Brexit” outcome is unveiled in a little over 12 hours. Gold gained from its lowest level in a week and nickel climbed to a one-year high.

“The market is adding risk assets again,†said Michael McCarthy, chief market strategist at CMC Markets in Sydney. “Clinton represents continuity, while Trump represents disruption. But as we’ve seen in the case of Brexit, anything could happen and so there’s still a lot of uncertainty surrounding the elections until we see the actual results.â€

As reported yesterday, on websites that take wagers on the election winner, Democratic candidate Clinton’s odds of victory are generally near or above 80 percent, boosted by Sunday’s news that the Federal Bureau of Investigation won’t revisit its decision against seeking criminal charges related to her e-mail practices while Secretary of State. Global equities slumped last week and haven assets rallied after the FBI said on Oct. 28 that it had reopened a probe into her communications.

“Markets are currently in the grip of a risk-seeking mood following the latest FBI news, which is perceived as raising the chances of a Clinton win,†said Imre Speizer, a market strategist at Westpac Banking Corp. in Wellington. “A Trump win would cause a major reversal of the recent moves, so markets will be mostly preoccupied by the election during the day ahead.â€

“Although we have seen an improvement in risk appetite over the past 24 hours, markets remain wary of an election shock,†said Rodrigo Catril, a currency strategist at National Australia Bank Ltd. in Sydney. “A dollar-positive reaction is likely on news of a Clinton victory; a likely ‘risk off’ reaction to a Trump victory would mean dollar losses versus yen, Swiss franc and euro but gains elsewhere.â€

The election results are expected to be announced as early as 8pm on Tuesday, but can be delayed until well in the evening, offering some prospect of calm on Tuesday as investors digest China trade data for October. Exports from Asia’s biggest economy dropped 7.3 percent from a year earlier in dollar terms, more than the 6 percent decline forecast in a Bloomberg survey.

The first polls close in Indiana, home to Trump running mate Mike Pence, the state’s governor, and Kentucky. Both states are heavily Republican and likely to be carried by Mr Trump. For a complete preview of election night see this post.

Heading into election day, Bloomberg notes that the Stoxx Europe 600 Index was up 0.3% in early trading, with almost two shares climbing for every one that fell. Deutsche Post AG climbed 1.3% after announcing third-quarter profit jumped more than threefold. The MSCI Asia Pacific Index added 0.4 percent, led by gains in raw-materials producers. The Shanghai Composite Index climbed to a 10-month high and Hong Kong’s Hang Seng Index was headed for its best close in a week. Futures on the S&P 500 Index were modestly lower after soaring on Monday in a post-FBI relief rally.Â