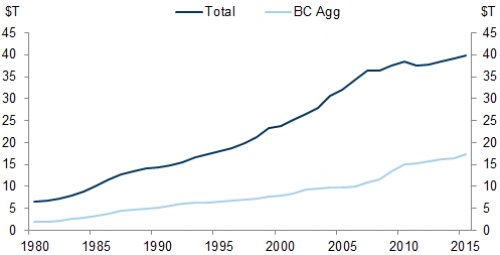

Back in June, we warned that based on simple duration analysis, as a result of total market-traded US debt aggregates anywhere between $17 and $40 trillion – an all time high in terms of rate duration…

…traders faced massive mark-to-market losses of anywhere between $2.4 and $5 trillion should rates suddenly spike higher…. as they did yesterday, when as we reported the yield on the 10Y and 30Y Treasury jumped the most in percentage terms on record.”The U.S. 10-year yield was three basis points, or 0.03 percentage point, higher at 2.09 percent as of 12:09 p.m. in London, according to Bloomberg Bond Trader data. The yield jumped 20 basis points Wednesday, the most on a single day since July 2013.”

Today, Bloomberg has crunched the numbers after yesterday’s bond rout, and calculates that bond investors saw $337 billion – just over a third of a trillion – in losses on global bond holdings in a single day Wednesday “as Donald Trump’s election as U.S. president sparked concern his plan to boost economic growth will lead to a surge in inflation.”

The sharp, aggressive selloff, which continues today, spread into European and Asian bonds on Thursday, as traders caught up with moves in U.S. Treasuries. Speculation that Trump’s victory and a Republican-led Congress will lead to a wave of spending, spurred the likelihood that inflation will pick up in coming months, which would in turn erode the value of bonds. The decline in bonds saw Bank of America Merrill Lynch’s Global Broad Market Index drop by about 0.7 percent on Wednesday.

Having been stuck in NIRP hibernation for years, the market suddenly had to look up what this thing called “duration risk” is.

“Right now bonds are in some trouble,†said Barra Sheridan, a rates trader at Bank of Montreal in London. There is some concern that Trump “will be more fiscally expansionary, he will look to spend more money.â€