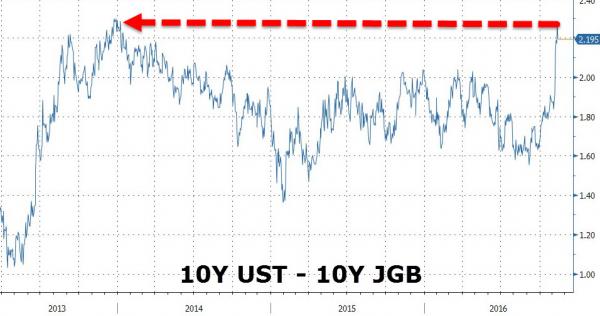

At 225bps, the extra yield gained from buying 10Y US Treasuries over 10Y JGBs appears to have been the catalyst for tonight’s sudden moves in bond markets. The widest spread since 2013 has sparked JGB selling (10Y JGB yields +2bps broke above 0.00% and back at their highest since March) and UST buying (10Y UST -6bps, 30Y<3.00%)

“Why don’t we invest in the U.S. and forget about JGBs?” said Kazuaki Oh’E, the head of fixed income at CIBC World Markets Japan Inc. in Tokyo.

And that appears to be what investors have done… (sending 10Y JGB yields above 0%)…

Leaving Japanese banks a little overextended as the yield curve goes nowhere…