DIY investing is alive and well. And no, we’re not talking about $ETSY.

We hear this question all of the time: will robo-advisors cannibalize the online brokerage industry? Is DIY investing a thing of the past? Both are great questions, since robo-advised assets are expected to double each year through 2020. Despite analyst predictions to the contrary, recent data suggest that self-directed investing is growing, not dying. Where is all the robo-advised money coming from? For the most part, it’s flowing out of savings accounts and traditional financial advisors.

BROKEN BARRIERS TO ENTRY: HORIZONTAL GROWTH

In the past 10 years, the online brokerage industry has lowered fees, slashed account minimums, and built more education & research tools across the board. The result has been an explosion in the number of accounts, which has grown by 4% YoY since 2007 as more women, millennials, retirees and boomers have decided to take the reins on their investments.

MORE ENGAGEMENT: VERTICAL GROWTH

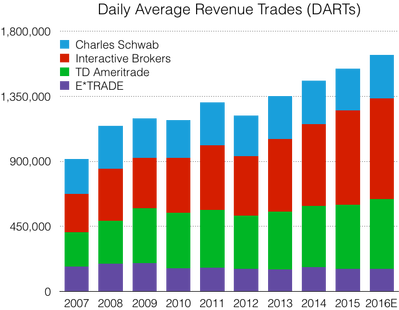

The subset of active investors & traders has grown twice as quickly as the overall investor population. The active subsets trade more often than their buy-and-hold counterparts, and the growth of this demographic is represented in the brokers’ trade volumes. Since 2007, the number of trades from retail investors has increased by 6.7% each year, on average.

This uptick is only the beginning. Mobile devices are driving engagement across the consumer-finance industry, but especially for active investors. Mobile banking is great, but there’s rarely a need to check your banking app more than once a day. Mobile investing is another story: during market hours, active traders stay engaged nonstop, no matter where they go.

WHERE ARE ROBO ASSETS COMING FROM?

Since robo-advisors encourage a “set-it-and-forget-it†mindset, they attract the client base of a financial advisory, not a retail brokerage. Self-directed investors prefer to be in complete control of their own investments. Whether they want to “beat the market†or simply invest in companies they believe in, they are not interested in handing off the responsibility to anyone, whether it is a human advisor, or an algorithm.