Gold prices edged higher on Tuesday, snapping a three-day losing streak, as a retreat in the dollar sparked some short-side profit taking. At the beginning of the week, the XAU/USD pair initially headed lower towards the $1210/8 zone but found enough support in the vicinity and managed to climb back above the $1220 level. Gold has dropped nearly 8% from last week’s high of $1337.16 and is currently trading at $1226.48 an ounce.

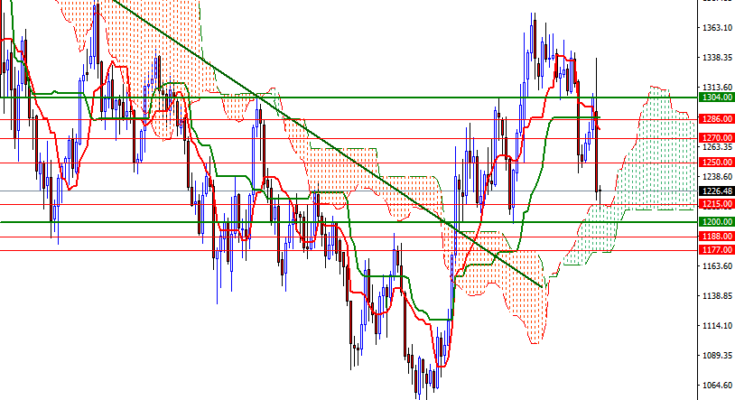

The short term technical picture remains bearish, with the market trading below the Ichimoku clouds on the daily and 4-hourly time frames. However, the weekly cloud sits right below the market and occupies the area between the 1215 and 1177 levels. That being the case, I think gold prices will tend toward consolidation for the next few days.

To the upside, keep an eye on the 1237 level. Clearing this resistance would give the bulls a chance to challenge 1243/0. Closing beyond 1243 on a daily basis paves the way towards the 1250/49. This area had served as a floor in the past so now it should act as solid resistance. The bears will have to drag XAU/USD back below the aforementioned 1220 support level so that they can make a fresh assault on the 1215 level. If this support is broken, then the market will be testing the 1210/8 area afterwards. A break below the 1208 level would open up the risk of a move towards the 1200-1197 zone.