This week was loaded with Federal Reserve speeches, media appearances and interviews. But the most important was Janet Yellen, who gave an upbeat presentation of the U.S economy while also clearly supporting an interest rate increase at an upcoming meeting, barring some type of negative economic shock.

Her comments highlighted the following economic data points:

Employment

Job gains averaged 180,000 per month from January through October, a somewhat slower pace than last year but still well above estimates of the pace necessary to absorb new entrants to the labor force. The unemployment rate, which stood at 4.9 percent in October, has held relatively steady since the beginning of the year. The stability of the unemployment rate, combined with above-trend job growth, suggests that the U.S. economy has had a bit more “room to run” than anticipated earlier. This favorable outcome has been reflected in the labor force participation rate, which has been about unchanged this year, on net, despite an underlying downward trend stemming from the aging of the U.S. population.

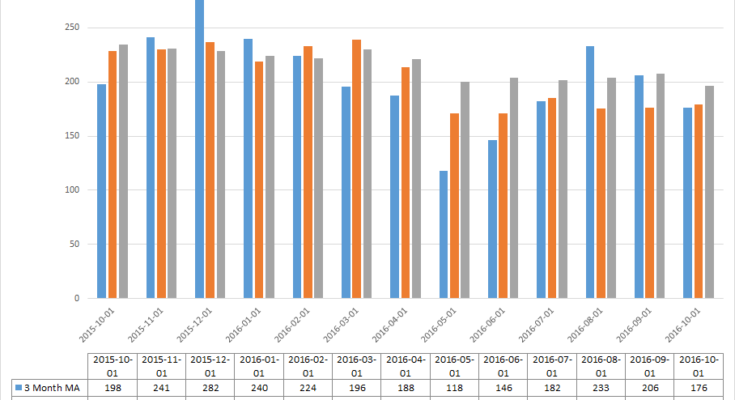

The following charts clarify the points made above:

The top chart shows the 3, 6, and 12 month moving averages of employment gains for the last year. With the exception of 3-month averages dip in March and April, all three have been above 150,000, which means job growth is sufficient to absorb population growth. The middle chart shows the unemployment rate, which has been slightly below 5% for the better part of 2016. The bottom chart shows the labor force participation rate, which, like the unemployment rate, has moved sideways since January. All three charts show a strong job market.

Consumer Spending:

Consumer spending has continued to post moderate gains, supported by solid growth in real disposable income, upbeat consumer confidence, low borrowing rates, and the ongoing effects of earlier increases in household wealth.

The following two chart clarify the points made above: