Gold settled down $25.56 at $1187.21 on Wednesday, weighed down by strong U.S. economic data. The XAU/USD pair fell sharply after data released by the Commerce Department showed that demand for durable goods rose 4.8% in October. Technical selling was also behind the market’s decline yesterday. A breach of a key support in the $1200-1197 contributed further pressure on the market. As a result, the XAU/USD pair traded as low as $1181.67.

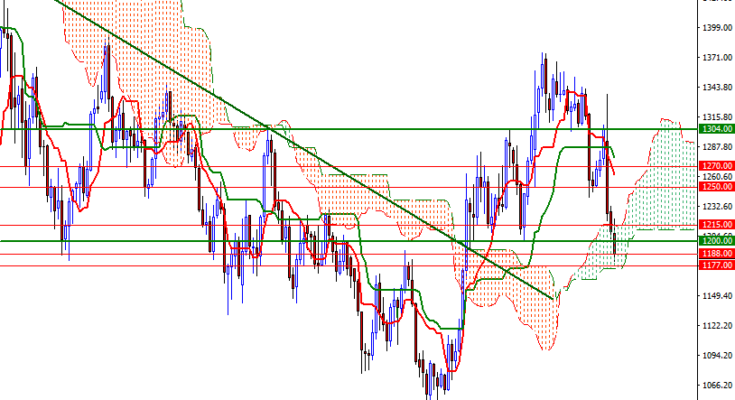

From a technical perspective, there are two things catch my attention at first glance. First of all, the recent downswing may remain intact as long as the market trades below the Ichimoku cloud on the 4-hour time frame. However, I advise a bit of caution at this point because there is a strategic support right below in the 1177/5 region.

This area coincides with the bottom of the weekly clouds at the moment and it had caused prices to reverse in the past. Therefore, we need to get down below there in order to continue to the downside. In that case, 1170/69 could be the next stop. Once below that, the market will be aiming for 1165/3. To the upside, the initial resistance stands at around 1192.50. If the bulls can push prices back above 1192.50, they will probably have a change to approach 1200-1197. This area is the key resistance for the bulls to penetrate so that they can proceed to the 1210/08 zone.