If you are an income-investor, you may have noticed that dividend yields just jumped for many healthcare REITs, especially over the last quarter. The reason yields jumped is because many fearful investors rotated out of the industry due to macroeconomic headwinds and regulatory uncertainties. As contrarian investors, this article highlights the best and worst performers, and shares our views on several specific investment opportunities.

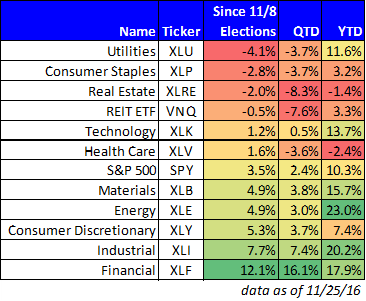

This first chart shows the recent performance across various market sectors, as measured by sector exchange traded funds.

Source: Yahoo FInance

The first thing that stands out about this chart is that the safer, bigger-dividend, sectors have under-performed over the last quarter, and particularly since the November 8th elections in the US. Â And over the last quarter, two particularly poor performers have been REITS and Health Care as measured by VNQ and XLV, respectively.

REITs have underperformed due to a sector-rotation caused mainly by macroeconomic headwinds. Specifically, as the prospects of stronger economic growth have risen, investors have sold safe, low-volatility, big-dividend REITs in favor of “growthier†sectors such as financials and industrials. Further, the prospects of increasing interest rates puts more pressure on REITs as their yields will become relatively not-as-attractive compared to increasing rates on fixed income securities. Plus, REITs rely on a fair amount of debt to fund their businesses, and rising rates will make it more challenging for REITs to fund growth. And all of these growth concerns were increased following the November 8th US elections whereby the unexpected president-elect appears to be pushing a very pro-growth pro-spending agenda. And on top of that, there was a bit of euphoria leading up to the recent carve-out of a new REIT sector which has since subsided and added downward pressure to the sector. In a nutshell, if you are a contrarian, REITs are worth a closer look (more on specific REITs later).