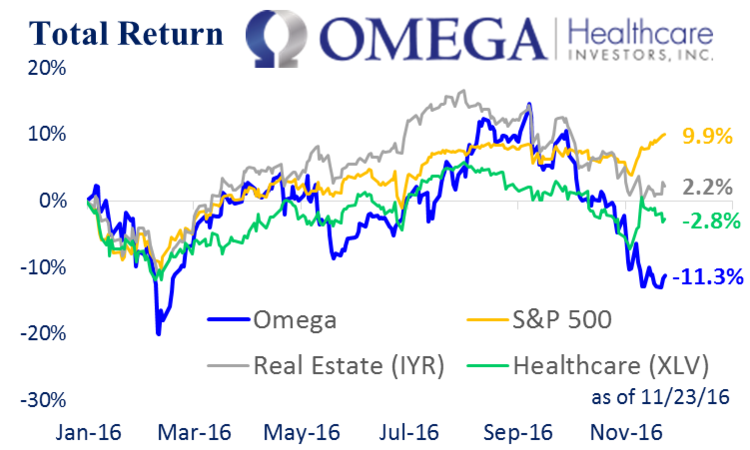

Omega Healthcare Investors (OHI) is an attractive, big-dividend (8.5%), real estate investment trust (REIT). Omega has delivered poor performance so far this year (as shown in our recent article: Big-Dividend Healthcare REITs, Ranking the Best and Worst) not only because of macroeconomic headwinds that caused REITs to pullback, but also because of heightened Affordable Care Act (ACA) uncertainty (especially following the recent U.S. elections), and because of the market’s overly pessimistic view of skilled nursing facilities (for example, short-interest is significantly high). We believe these three big risks (i.e. macroeconomic headwinds for REITs, ACA uncertainty, and overly pessimistic sentiment) have created an attractive opportunity for diversified long-term investors.

Overview

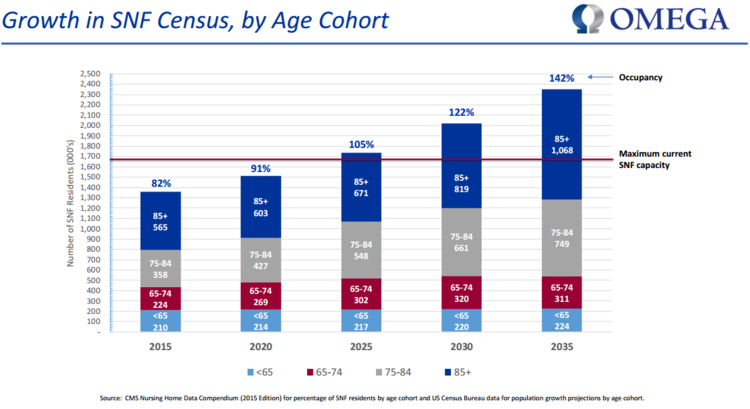

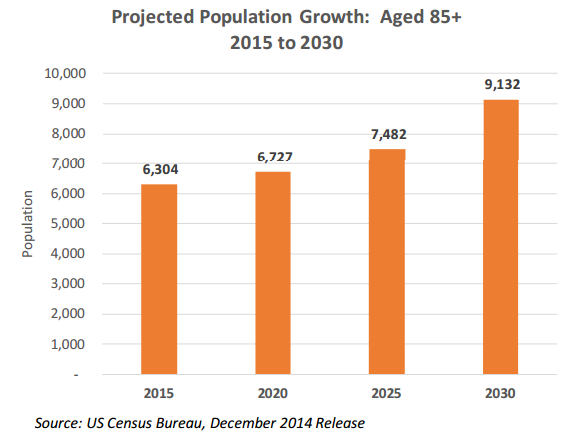

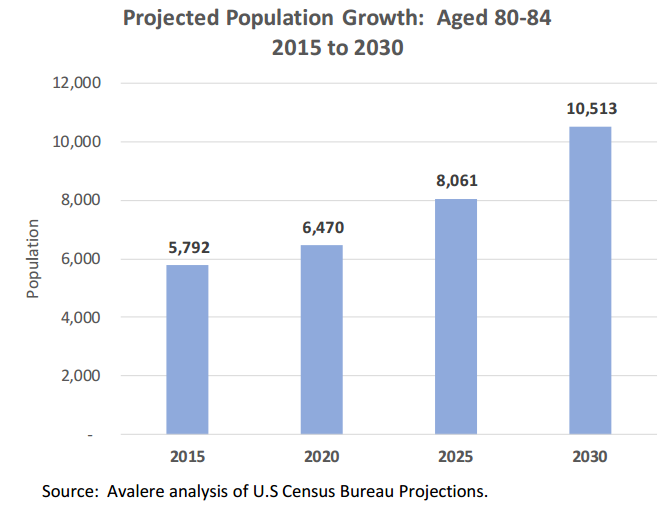

Omega is a triple-net equity REIT that provides financing to support Skilled Nursing Facility (SNF) operators. And considering the shifting demographics of the US population, Omega has a big tailwind at its back that will help it going forward as shown in the following charts.

source

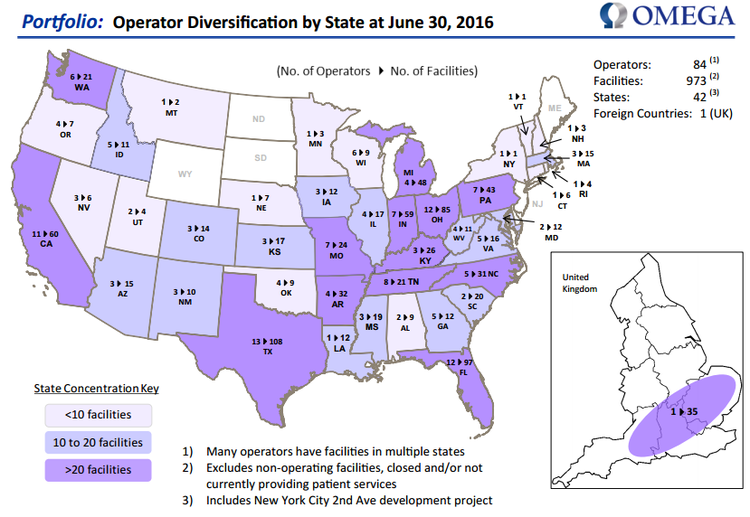

And the following map provides information on the well-diversified locations of Omega’s properties.

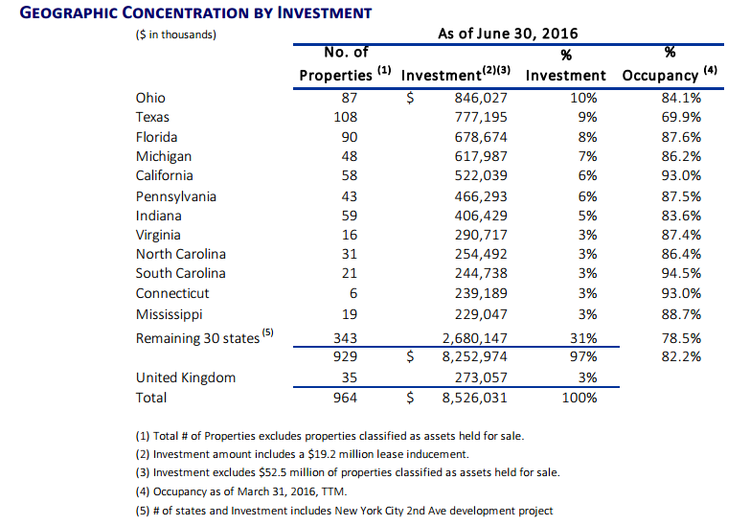

This next table provides additional information on the diversified nature of Omega’s investments by dollars, geographic location and occupancy.

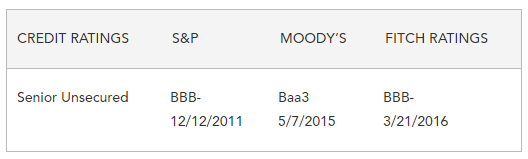

And worth noting, Omega maintains healthy investment grade credit ratings (as shown in the following table).

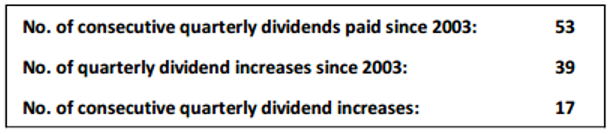

Also worth noting, Omega has an outstanding dividend payment record as shown in the following graphic.

Despite all of the good things Omega has going for it, the share price has declined and underperformed this year as shown in our earlier performance chart.

Macroeconomic Headwinds

One of the reasons why Omega has underperformed recently is macroeconomics. Specifically, real estate securities (and high dividend stocks in general) have sold off as the outlook for growth continues to improve, especially following the recent US elections. With regards to growth, investors have rotated from low volatility stocks (such as REITs) and into “growthier†investments such as financials and industrials. This rotation has caused REITs (such as Omega) to underperform the rest of the market as shown in the previous total returns chart. Another macroeconomic reason REITs have sold off is because they generally use a fair amount of debt (see debt bar chart below) to fund their businesses, and interest rates are increasingly expected to rise which will make operations more expensive for REITs. However, Omega’s business remains healthy and its valuation is attractive (more on valuation later).