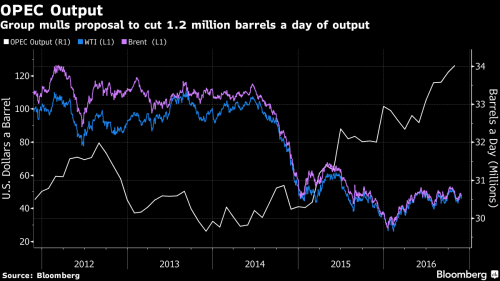

European stocks were little changed and oil fell as investors assessed declining prospects for an OPEC deal and risks from Italy’s referendum. Asian stocks declined, while S&P futures pointed to a fractionally higher open, erasing 3 points from yesterday’s drop.

Trader attention today – and tomorrow – will be focused on oil which retreated back under $47 as OPEC members failed to bridge differences on production cuts, while a rally in metals ran out of steam. The rand plunged after President Jacob Zuma survived a leadership threat.

“We have a very important OPEC meeting and there’s a flow of expectations in front of this meeting, therefore the oil price is shaky as well as oil-related companies,†Herbert Perus, head of equities at Raiffeisen Capital Management in Vienna, told Bloomberg. The market is giving just 30% odds to an agreement to end the oil supply glut, according to Goldman Sachs; pessimism about the make-or-break talks is helping to damp a commodities rally.

Commodity and energy producers were the biggest decliners in the Stoxx Europe 600 Index. Crude slid as Iraq and Iran raised objections over the distribution of output reductions and Russia said it’s not planning to attend crucial talks with the Organization of Petroleum Exporting Countries on Wednesday (more in a subsequent update on oil prices). “What we are seeing now is a tug of war among OPEC members to get their share of the pie,†Son Jae Hyun, a global market analyst at Mirae Asset Daewoo Co., said by phone from Seoul. “If a deal isn’t made this time, none of them will benefit.â€

Copper slumped for the first time in seven days and the Bloomberg Dollar Spot Index ended a two-day loss. The rand was the biggest decliner among major currencies.

European shares posted modest gains in early trading on Tuesday, after taking a battering from banks the previous day, but weak oil prices before a meeting of OPEC producers limited gains. 8 out of 19 Stoxx 600 sectors fall with basic resources, oil and gas underperforming while financial services outperforming; about half of Stoxx 600 members decline.

Italian banking stocks staged a recovery but miners came under renewed selling pressure after a sharp decline in commodities prices. Oil prices fell more than 1.5% on jitters over whether OPEC would be able to hammer out a meaningful output cut during a meeting on Wednesday to rein in a global supply overhang and prop up prices.

The miner-heavy FTSE 100 index was down 0.38% but the FTSE Mid 250 was up 0.15% 0940 GMT (5:40 a.m. ET). “The fact that the FTSE 100 is going one way and the FTSE 250 is going the other way suggests that there is a sector specific event going on, as the FTSE 100 is more commodities heavy,” said Investec economist Philip Shaw cited by Reuters.

There was a slew of European economic data reported this morning, most of which either met or exceeded expectations:

- (FR) 3Q P GDP 0.2% QoQ; est. 0.2%, prior 0.2%

- (FR) 3Q P GDP 1.1% YoY; est. 1.1%, prior 1.1%

- (FR) Oct. Consumer Spending 0.9% MoM; est. 0.25%, prior -0.2%

- (FR) Oct. Consumer Spending 1.5 YoY; est. 1.0%, prior 0.7%

- (EC) Nov. Economic Confidence 106.5; est. 106.8, prior 106.3

- (EC) Nov. Industrial Confidence -1.1; est. -0.5, prior -0.6

- (EC) Nov. Services Confidence 12.1; est. 12.5, prior 12

- (EC) Nov. Consumer Confidence -6.1; est. -6.1, prior -6.1

- (EC) Nov. Business Climate Indicator 0.42; est. 0.6, prior 0.6

The MSCI index of Asia-Pacific shares outside fell 0.27% after two days of gains. Tokyo stocks slipped 0.3% hit by a stronger yen. Asian stocks fell after a three-day rally as investors adopted a cautious tone ahead of key events from OPEC talks to the U.S. jobs report and Italy’s referendum.8 out of 10 sectors fall with industrials, energy underperforming and telcos, financials outperforming.Chinese stocks rose by 0.2% with the Shanghai Composite reaching 3,283: “The government is tightening property so maybe some of that excess liquidity is flowing into the A-share market again,†said Ben Kwong, a Hong Kong-based director at KGI Asia Ltd.

The moved higher on the yen to reach 112.62 after month-end flow profit-taking pulled it down as far as 111.58. It remains over 7% higher for the month. Dealers reported Japanese buying for the new month with orders today settling on Dec. 1. Against a basket of currencies, the dollar held at 101.280 .DXY and not far from last week’s 14-year peak. The greenback was still on track for its strongest two-month gain since early 2015, underpinned by expectations the Federal Reserve is almost certain to hike interest rates next month.

European government bond markets were also trending in this direction, with safe-haven Germen government bond yields up 1-2 basis points and lower-rated Italian, Spanish and Portuguese bond yields lower. Italian 10-year bonds posted a modest advance, with the yield falling five basis points to 2.02%, but the gain comes just days after the bond yields hit their highest level since September 2015. The rebound came after Prime Minister Matteo Renzi’s office denied news reports that he is considering stepping down even if he wins the Dec. 4 referendum on constitutional reform.

Italian bond yields have been rising before Sunday’s referendum on constitutional change, on which Prime Minister Matteo Renzi has staked his future.