The Indian share markets continue to trade in the green during the noon trading session amid expectations of positive gross domestic product (GDP) data to be released later in the day. Sectoral indices are trading mixed with capital goods, banking, and consumer durables stocks witnessing maximum buying interest. While metal and realty stocks are trading lower.

The BSE Sensex is trading higher by 99 points (up 0.4%) while the NSE Nifty is trading higher by 35 points (up 0.4%). The BSE Mid Cap index is trading up by 0.6% and BSE Small Cap index is trading up by 0.9%. Gold prices, per 10 grams, are trading at Rs 28,672 levels. Silver price, per kilogram is trading at Rs 40,739 levels. Crude oil is trading at Rs 3,146 per barrel. The rupee is trading at 68.65 to the US$.

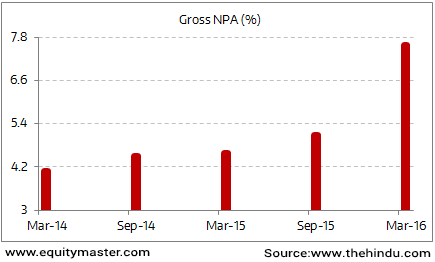

Stocks in Public Sector Banks are trading on positive note with only union bank and bank of Maharashtra trading in the red. While demonetization and incremental taxes are being slapped on black money holders on the one side, bad loans are rising at an alarming rate on the other. The Union government has announced that the gross non-performing assets (NPAs) of the Public sector banks (PSBs) have seen nearly Rs 800 million increase in three months ended September 2016.

PSBs continue to play with fire by offering waivers to creditors, resulting in an increase in gross NPAs. As on September 30, gross NPAs of PSBs rose to Rs 6303.2 billion as against Rs 5503.5 billion by June end. This works out to an increase of Rs 799.8 billion on quarter on quarter basis.

Rise & Rise of Stressed Loans

Â

Reportedly, the RBI projects the gross NPA of banking sector to go up to 8.5% by March 2017.

In this regard, the government has taken sector-specific measures (infrastructure, power, road textiles, steel etc.) where incidence of NPA is high. According to the Minister of State for Finance Santosh Kumar Gangwar, listed measures like enactment of the Insolvency and Bankruptcy Code (IBC), amendment of the Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act (SARFAESI) and the Recovery of Debt due to Banks and Financial Institutions (RDDBFI) Act aimed at improving resolution or recovery of bank loans.