Following a November to remember, which saw tremendous market gains following the election of Donald Trump, December has started off on the back foot, with US equity futures lower, European stocks halting a two day advance ahead of the Italian referendum, US Treasury yields higher and the US dollar backing away from a 9 month high.

One place where recent euphoria has continued was oil, where following yesterday’s OPEC oil deal and 9% surge in crude, WTI continued its ascent and was trading above $50 in early trading, however skepticism about the rally is building with stories such as “Oil price rally likely short-lived as OPEC deal not enough to reduce glut” from Reuters and “Hangover Awaits as OPEC Celebrates Its Biggest Accord in Years” from Bloomberg.

Analyst were also skeptical: “Oil could go up to $60, but then the shale drillers come out and the price will likely come back down,†Keigo Matsubara, chief financial officer of the Japanese trading house said in an interview Thursday. “Oil can’t continue over $50.â€Â

“The question is whether this (production cut) is going to put a floor under the oil price from here. The answer to that could well depend on what happens with the global economy in the coming year,” said Simon Smith, chief economist at FXPro.

All eyes are now on whether the OPEC deal will hold together. If the bounce in oil prices gathers pace after the OPEC deal it is expected to have a broad implication on the global economy. OPEC’s output cut is also seen as a boon for U.S. shale producers, rivals to the oil cartel. The S&P energy index SPNY jumped nearly 5 percent on Wednesday.

While November may have been one of the most unforgettable months in markets in years, December is shaping up just as exciting: this is the month of the Italian referendum, the Austrian election (where Europe’s first far right leader since WWII could be elected), a probable Fed hike (only the second in 10 and a half years) and a big ECB decision on what next for QE.

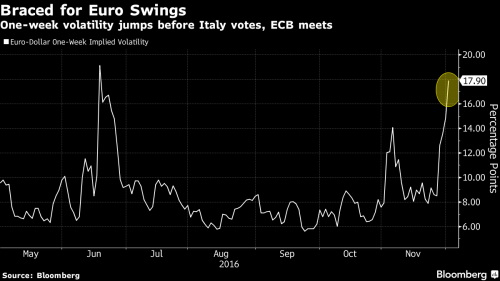

Ahead of these events, the U.S. dollar declined against most of its 16 major peers before a payrolls report on Friday, while a measure of euro volatility jumped to the highest since before the Brexit vote as investors brace for Italy’s referendum and Austria’s presidential election on Dec. 4 and the European Central Bank’s policy decision in a week’s time.

The jump in oil prices added to inflation expectations in the United States, which were already rising on prospects that president-elect Donald Trump would adopt reflationary policies using a large fiscal stimulus. As a result the rout in U.S. Treasuries resumed, with yields pushing higher, especially on longer-dated bonds.Â

The overnight slump in Treasuries extended the biggest climb in 10-year yields since 2009. The 10Y Treasury yield increased three basis points to 2.41% after surging nine basis points Wednesday to their highest close since July last year. It jumped 56 basis points last month. The 30-year yield has climbed more than 40 basis points since the Nov. 8 presidential election, heading back towards a 14-month peak of 3.09 percent marked last week.

“Higher oil prices, talk of ultra-long issuance in the U.S. and strong U.S. data all helped push U.S. yields higher,” RBC Capital markets said in a note to clients on Thursday. “This remains our key theme for next year as well – we believe U.S. yields will keep leading the charge higher on improving macro backdrop and rising inflation expectations.”

10Y German bunds added 4 bps to 0.31%. Not surprisingly, according to Roger Bridges, the chief global strategist for interest rates and currencies in Sydney at Nikko Asset Management’s Australia unit, “a lot of people are beginning to think that it is the end of the bull rally.” The Bloomberg Barclays Global Aggregate Total Return Index of bonds fell 4 percent in November, biggest decline since index started in 1990.

The Stoxx Europe 600 Index lost 0.5% as all but three of the 19 industry groups retreated. S&P 500 Index futures slid 0.1 percent, signaling U.S. shares may continue their Wednesday decline. Glencore Plc gained 3 percent after saying its debt reduction plan is on track and it will reinstate its dividend next year. Banco Popular Espanol SA rose 3.5 percent after a report the lender is weighing a potential merger with another bank and has approached Banco Bilbao Vizcaya Argentaria SA, among others. Daily Mail and General Trust Plc rose 6.4 percent after it reported 2016 revenue that beat estimates.

“We are all waiting for the NFP tomorrow, the referendum in Italy this weekend and the ECB next week,†Athanasios Vamvakidis, head of G-10 currency strategy at Bank of America Merrill Lynch, said in an email. “It’s consolidation ahead of key events.”

Today, traders will be looking to non-farm payrolls data for more clues on the pace of interest-rate increases, after ADP Research Institute reported the biggest jump in private-sector workers since June.

Market Snapshot

- S&P 500 futures down 0.1% to 2196

- Stoxx 600 down 0.5% to 340

- DAX down 0.7% to 10569

- German 10Yr yield up 4bps to 0.31%

- Italian 10Yr yield up 1bp to 2%

- Spanish 10Yr yield up 1bp to 1.57%

- S&P GSCI Index up 0.5% to 378.9

- MSCI Asia Pacific up 0.6% to 137

- Nikkei 225 up 1.1% to 18513

- Hang Seng up 0.4% to 22878

- Shanghai Composite up 0.7% to 3273

- S&P/ASX 200 up 1.1% to 5500

- US 10-yr yield up 3bps to 2.41%

- Dollar Index down 0.27% to 101.23

- WTI Crude futures up 0.5% to $49.70

- Brent Futures up 0.7% to $52.21

- Gold spot down 0.4% to $1,168

- Silver spot down 0.8% to $16.38