“The slowdown in aggregate demand contributes to the fall in inflation. Yet, exchange rate movements due to recently heightened global uncertainty and volatility pose upside risks on the inflation outlook. The Committee decided to implement monetary tightening to contain adverse impact of these developments on expectations and the pricing behavior.†– The Central Bank of Turkey, November 24, 2016

Turkey’s central bank is in an awful bind. Turkey’s economy is getting squeezed at the same time its currency collapses. A little over a week ago the central bank chose what it thinks is the lesser of two evils and hiked interest rates in an attempt to support the Turkish lira.

“a) Overnight Interest Rates: Marginal Funding Rate has been increased from 8.25 percent to 8.5 percent, and borrowing rate has been kept at 7.25 percent,

b) One-week repo rate has been increased from 7.5 percent to 8 percent,

c) Late Liquidity Window Interest Rates (between 4:00 p.m. – 5:00 p.m.): Borrowing rate has been kept at 0 percent, and lending rate has been increased from 9.75 percent to 10 percent.â€

Unlike the rate hike nearly three years ago, THIS rate hike has so far failed to stem the bleeding in the lira. The Turkish lira continues to lose rapid ground to the likes of the U.S. dollar (USD/TRY) and even the euro (EUR/TRY).

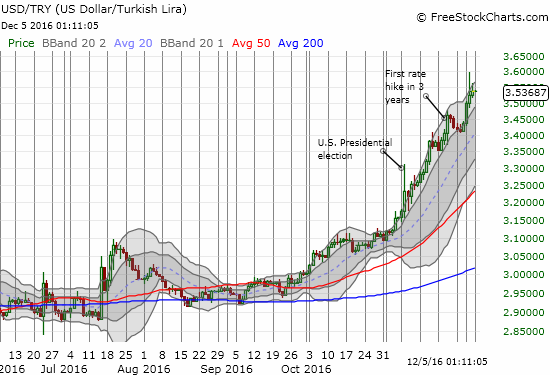

USD/TRY has sustained a parabolic move on a daily basis since a big breakout to all time highs at the beginning of November.

The rally in EUR/TRY confirms that the Turkish lira’s weakness is not just a disadvantage against the U.S. dollar.

USD/TRY is up about 15% since the end of October. The rally took a brief pause shortly after interest rates went up, but the rally picked right back up last week with just as much intense ferocity as before.

Here is a weekly chart for more perspective.

The Turkish lira: The picture of a currency in a near persistent collapse (USD/TRY rallying).