I’m a firm believer that the Canadian banks are a peer group that should hold a place in the portfolio of the dividend growth investor.

Among this peer group, Royal Bank of Canada (RY) – referred to as RBC – stands out. Besides just being the largest of Canada’s Big 5 banks, they have many traits that make them an attractive investment today – particularly regarding their dividend.

They are a member of the Canadian Dividend Aristocrats Index. This is a group of elite Canadian companies with 5+ years of consecutive dividend increases (not to be confused with the traditional Dividend Aristocrats Index, which is composed of companies with 25+ years of consecutive dividend increases).You can see the full list of ‘traditional’ Dividend Aristocrats here.

Looking back even further, RBC has paid steady or rising dividends every year since 1943. This demonstrates a level of staying power that is indicative of strong competitive advantages, high profit levels, and intelligent management.

Read on for a full analysis on the compelling investment prospects of Canada’s largest lender.

Business Overview

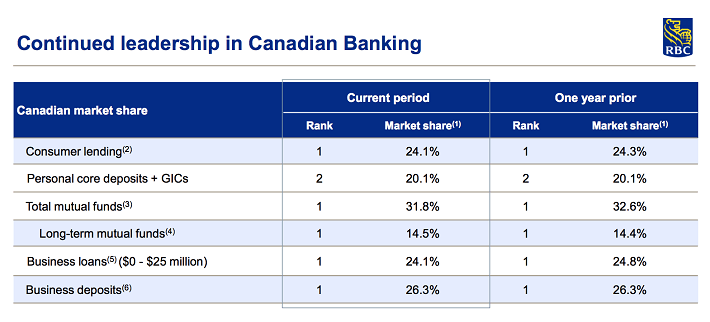

RBC is a diversified financial services provider. As the largest bank in Canada based on market capitalization (and a number of other factors, for that matter), RBC holds a leadership position in a number of personal banking product lines.

Source: RBC Fourth Quarter Investor Presentation, Slide 24

Given their size, it is no surprise that RBC holds a #1 spot in all but one market (where it holds a #2 spot).

RBC divides their operations into five main business segments:

- Personal & Commercial Banking:Â comprised of personal banking operations and certain retail investment businesses in Canada, the Caribbean and U.S. as well as our commercial and corporate banking operations in Canada and the Caribbean.

- Wealth Management:Â serves affluent, high net worth and ultra high net worth clients in Canada, the United States, and selected regions outside North America with a full suite of investment, trust and other wealth management solutions and businesses that provide asset management products and services through RBC distribution channels and third-party distributors.

- Investor & Treasury Services:Â serves the needs of institutional investing clients and provide custodial, advisory, financing and other services for clients to safeguard assets, maximize liquidity and manage risk in multiple jurisdictions around the world.

- Capital Markets:Â provides public and private companies, institutional investors, governments and central banks globally with a wide range of capital markets products and services across our two main business lines, Corporate and Investment Banking and Global Markets.

- Insurance:Â offers life, health, property and casualty insurance products as well as wealth accumulation solutions, to individual and group clients across Canada. We also offer reinsurance for clients around the world.

In general, RBC’s business model is quite similar to the other Canadian banks. Their main distinguishing feature is their focus on expansion in the U.S. markets, which I will elaborate on later.

I will now outline RBC’s recently announced financial performance before moving on to evaluate the Bank’s investment prospects.

Financial Performance

On November 30, RBC reported earnings for the 3-month and 1-year period ending October 31, 2016. This section will summarize their financial performance.