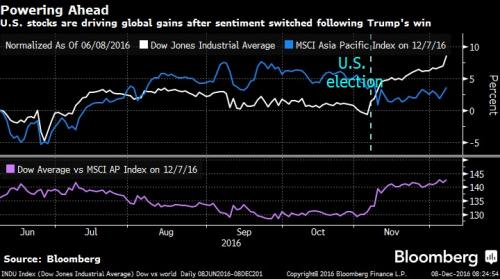

There’s seemingly no stopping the equity side of the “Trumpflation†trade in what may be developing into an epic year end blow-off top. The euphoria which took the S&P 500, Russell 2000 and the Transports to all-time highs yesterday, and the Dow to less than 500 points away from 20,000 carried over into Asian stocks (+0.8%) as they followed bullish trend, while European stocks rose for a fourth day. The exception was Shanghai, despite better-than-expected Chinese trade data, which suggested strengthening domestic and global demand, and thus a lower likelihood for future stimulus. November exports rose 0.1% (October -1.4%) year-on-year versus the consensus forecast of -5.0% and imports rose 6.7% (October -7.3%) versus consensus of a 1.3% fall.

As the title suggests, all eyes are on Draghi and the ECB which in very soon will provide a glimpse into how the ECB’s QE program will continue into 2017: “Today’s ECB meeting is expected to settle on an extension of asset purchases beyond the March 2017 end-date – perhaps for a further six months – but the decision to extend exceptional monetary support may not be unanimous,†Davy Research’s David McNamara writes in note. “Mario Draghi may signal the ECB’s intention to begin tapering when conditions allow, although explicit forward guidance is unlikely at this point. The rhetoric rather than the policy may therefore be the most interesting element of the announcement.â€

Needless to say, the market has been optimistic that anything Draghi says will be favorable for risk assets. A good summary of prevailing sentiment came from Ayako Sera, strategist at Sumitomo Mitsui, who told Bloomberg that globally, “we’re seeing a euphoric state continue, and investors will also be heading into the Christmas break soon, so we’re seeing some final moves to get into the market or close off positions.â€Â

Markets remain optimistic that Draghi will extend the ECB’s €80BN a month of bond buying at today’s ECB meeting, although technical difficulties associated with the bond purchases and new economic forecasts could complicate the ECB’s justification. Walking this tightrope will present a challenge for Draghi, with memories of last December’s debacle still in the mind (when market expectations of “more†were temporarily dashed, sending the Euro soaring).

Indeed, perhaps getting a case of cold feet, bonds dipped in the 11th hour on concern Mario Draghi may fail to deliver after all on stimulus

that’s already priced into the market. The euro gained for a second day. Italian bonds retreated after a rally sent 10-year yields to a three-week low ahead of Thursday’s European Central Bank meeting where it may announce it will prolong unprecedented quantitative easing.

“The market is just in general a little bit nervous whether Draghi will actually get this extension of QE through and whether it will be the same amount as before,†said Allan von Mehren, chief analyst at Danske Bank A/S in Copenhagen. “So we see a bit of anxiety ahead of the decision but it has been quite volatile. The liquidity right now is not great. A lot of people are sidelined, so I don’t think it takes big trades to move the market.â€

Perhaps driven higher by worries of a surprise tightening hint, the euro approached a one-month high against the dollar on a closing basis. A gauge of European stocks moved higher toward a three-month peak while S&P 500 Index futures fluctuated after closing at a record high.European stocks opened firmer this morning, led by the DAX (+0.50%) and Spain’s IBEX (+0.5%). US equity futures are marginally higher (+0.07%) in early European trade.

The dollar index (DXY) briefly dipped back beneath 100.0 level as the Yen continued to recover from its recent low of 114.72. The sagging dollar also helped to revive gold after its recent trip to the woodshed, which saw it fall from $1,305/oz to a low of $1160/oz. It was trading at $1,176/oz. in the European open.  Â

Bond markets in Asia Pacific were generally stronger, led by Australia and South Korea, although the yield on 10-year JGBs was 1.4bp higher at 3.6bp. European bond markets are opening up weaker, but only marginally with yields up 1-2bp. Following the British Parliament’s vote to back PM Theresa May’s decision to trigger Brexit by 31 March 2017, Gilts are bucking the trend. The yield on the 10-year Gilt is 5.8bp lower at 1.354%. The yield on 10-year Italian bonds climbed seven basis points to 1.95 percent at 10:45 a.m. in London. The euro advanced 0.3 percent to $1.0790. The Stoxx 600 increased 0.3 percent after trading little changed and S&P 500 futures added less than 0.1 percent. Oil traded near $50 a barrel in New York. Spain’s 10-year bond yield increased five basis points to 1.47 percent and Germany’s was three basis points higher at 0.38 percent. Yields on Treasuries due in a decade rose three basis points to 2.37 percent, after falling five basis points on Wednesday.

Market Snapshot

- S&P 500 futures flat at 2,232

- Stoxx 600 up 0.2% to 348.3

- FTSE 100 up 0.1% to 6907.8

- DAX up 0.5% to 11,040

- German 10Yr yield up 0.7bp to 0.345%

- Italian 10Yr yield up 3bp to 1.91%

- Spanish 10Yr yield up 3bp to 1.45%

- S&P GSCI Index down 1% to 383.4

- MSCI Asia Pacific up 0.8% to 137.1

- Nikkei 225 up 1.5% to 18,765.5

- Hang Seng up 0.3% to 22,861

- Shanghai Composite down 0.2% to 3,215

- S&P/ASX 200 up 1.2% to 5,543.6

- US 10-yr yield up 1bp to 2.35%

- Dollar Index down 0.2% to 100.0

- WTI Crude futures up 0.1% to $49.82

- Brent Futures flat to $53.07

- Gold spot up 0.1% to $1,176.6

- Silver spot flat at $17.12

Global Headlines

- Europe Stocks Advance as Global Stocks Rally Before ECB Decision          Â

- Russia Sells $11 Billion Stake in Rosneft to Glencore, Qatar                    Â

- Draghi’s Stimulus Message Set to Be Scanned for Ultimate QE Plan         Â

- Samsung Said to Plan All-Screen Design in Galaxy S8 Phones                  Â

- Volkswagen Engineers Change in the Eye of the Diesel Storm                   Â

- UniCredit Sells Pekao Stake for $2.6 Billion to Lift Capital                       Â

- Monte Paschi Asks ECB for More Time to Finish Capital Hike                     Â

- Sports Direct’s Ashley Waits on Corporate Plane as Profit Slumps            Â

- U.K.’s Capita to Sell Units, Cut 2,000 Jobs as Brexit Weighs                     Â

- Glencore Dealmaking King Returns With Wager on Oil and Putin               Â

- Kremlin Gold Paves Way to Billionaire Fortune for Tito’s Valet