While Italy scrambles to conclude a private sector rescue of ailing Monte Paschi, which hopes to raise €5 billion in the form a share sale to anchor and retail investors, while at the same time the bank is underoing a debt for equity swap, moments ago Reuters reported that Italy’s cabinet will meet later on Monday to authorise an increase to the national debt to cover the cost of saving Monte dei Paschi di Siena, should a public bailout be unavoidable, as well as other ailing banks, government sources said cited by Reuters.

As reported yesterday, Monte dei Paschi has launched a 5-billion-euro (4.2 billion pounds) capital increase and must raise the money by the end of the year or face being wound down. If it cannot find takers in the private sector, the government will be forced to step in.

Sources told Reuters last week that the government was ready to pump €15 billion euros – just under one percentage point of gross domestic product – into Monte dei Paschi and other ailing banks. Before it can do that, it needs authorisation to lift national debt levels, which it will do tonight at 7:30pm CET when the cabinet will meet with the Italian parliament to discuss increasing Italy’s public debt to fund bank bailouts.

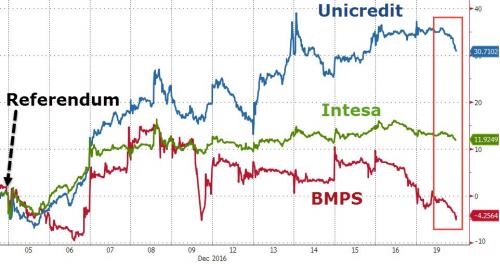

Meanwhile, after having soared in the early part of December following the failed Renzi referendum, Italian banks slid today on concerns over the successful conclusion of the Monte Paschi bailout.

The reason for today’s selloff may be that, as Reuters also reports in a separate note, Monte Paschi is trying to resolve differences with a key investor over the 5 billion euro rescue plan.  Monte dei Paschi has failed to find buyers for its shares so far Reuters notes, adding that on Monday, it shook the market again with a warning that Italian bank industry bailout fund Atlante was rethinking its 1.5 billion euro purchase of bad loans from the lender.

Atlante had expressed “deep reservations” in a Dec. 17 letter over the terms of a bridge loan that Monte dei Paschi had secured as part of the sale of bad loans, the bank said. Monte dei Paschi shares extended losses on the news, erasing a week’s gains to trade down 7.7 percent at 19.3 euros each.