Yesterday we reviewed the outlook for stocks based on a momentum profile from the vantage of the major asset classes, according to a set of proxy ETFs. Today’s focus turns to bonds around the world, using prices as of Dec. 27. Once again, the analytical lens is a two-part toolkit: 50- and 200-day moving averages, supplemented with a trailing one-year (252 trading days). The goal: develop some intuition about the near-term outlook for various slices of the global markets. Since the agenda is analyzing price trends, we’ll strip out distributions and look at price-only data, using charting resources via StockCharts.com.

As a preview, the main takeaway is that a bearish pall hangs over fixed income. The recent jump in interest rates has taken a toll, with one exception: junk bonds in the US. Why has junk managed to remain in the black when the rest of the field has suffered? One theory is that the higher yields of late reflect new expectations of stronger growth in the wake of Donald Trump’s election. While that’s generally a negative for investment-grade bonds, junk often trades as an equity proxy and so the higher prices in this corner of fixed income are tracking the rebound in US stock prices.

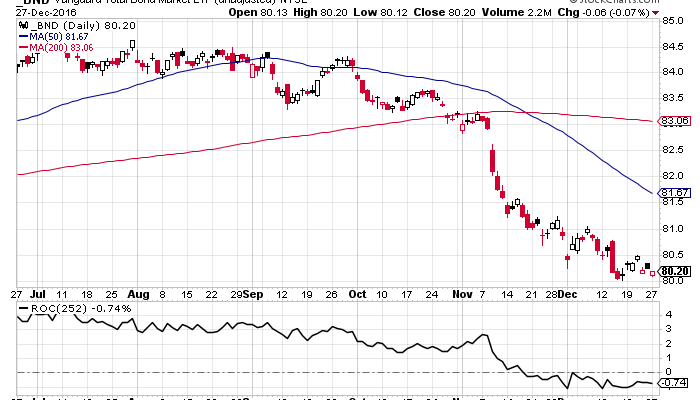

Let’s take a closer look, starting with US bonds other than junk. A bearish cloud weighs on a broadly defined measure of fixed income that’s primarily defined by Treasuries and investment-grade corporates. Vanguard Total Bond Market (BND) has tumbled since early November, and a negative skew for the moving averages and one-year return suggest that a rebound is nowhere in sight.

Inflation-indexed Treasuries don’t look much better, although iShares TIPS Bond (TIP) are still sitting on a modest one-year gain in price-only terms.

US junk bonds, by contrast, continue to trend higher. For the moment, the recent rise in interest rates hasn’t been a problem for below-investment-grade bonds. SPDR Bloomberg Barclays High Yield Bond (JNK) is up 8% (in price-only terms) for the past year and its 50-day average remains well above its 200-day average.