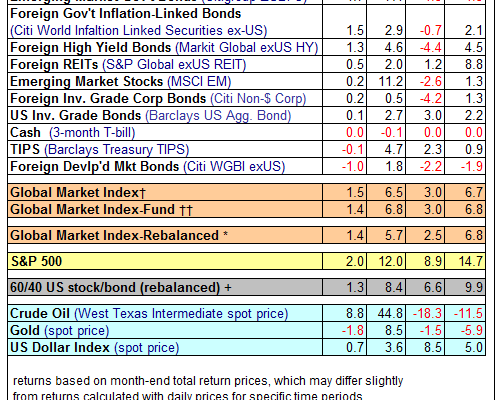

Global markets ended 2016 on a (mostly) positive note. Except for inflation-indexed Treasuries and foreign developed-market government bonds, all the major asset classes posted gains in December. For the year overall, everything was up, except for cash (3-month T-bills). The positive skew for 2016 marks a bullish change from 2015’s year-end summary, when red ink weighed on most markets.

Last month’s big winner: US real estate investment trusts (MSCI REIT), which bounced back in December with a strong 4.7% total return after sliding for four straight months. December’s biggest loser: foreign developed-market government bonds (Citi WGBI ex-US), which slumped 1.0% in last year’s closing month.

For the year, US junk bonds topped the list. Markit’s iBoxx Liquid High Yield Index surged 15.3% in 2016, beating the 12.8% increase for the number-two performer (US stocks via the Russell 3000) by a comfortable margin. The only loser among the major asset classes last year: cash (3-month T-bills), which inched down 0.1%.

The upside bias in December lifted the Global Market Index (GMI), an unmanaged benchmark that holds all the major asset classes in market-value weights. GMI added 1.5% last month, boosting the benchmark’s total return for 2016 to a respectable 6.5%.