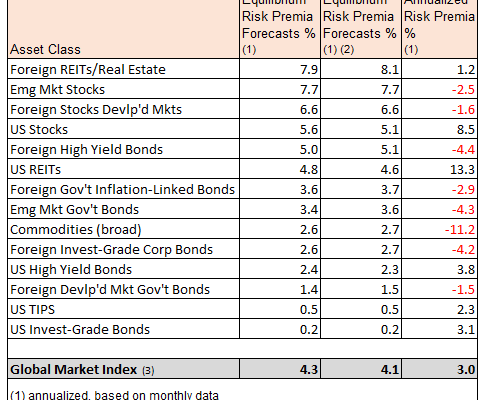

The expected risk premium for the Global Market Index (GMI) held steady in December, remaining at the highest level in over two years. GMI, an unmanaged market-value weighted mix of the major asset classes, is currently projected to earn an annualized 4.3% over the long term—unchanged from last month’s estimate.

Today’s update continues to mark a rebound following the below-3.0% estimates in late-2015 and early 2016.

Adjusting for short-term momentum and longer-term mean-reversion factors (defined below) trims GMI’s current ex ante risk premium to an annualized 4.1%, although this projection also marks a rebound vs. estimates in recent history.

The realized risk premium for GMI for the trailing three-year period ticked up to 3.0% last month, although that’s still close to the slowest pace in four years. Using the projected return for GMI as a guide, however, implies that the benchmark’s performance will inch higher in the years ahead.

Â

For some historical perspective, here’s a recap of how GMI’s risk premium estimates have evolved over the last two years:

Â

Turning to what the markets actually delivered, here’s a chart of rolling three-year annualized risk premia for GMI, US stocks (Russell 3000) and US Bonds (Bloomberg Barclays Aggregate Bond Index) through last month.

Â

Finally, here’s a summary of the methodology and rationale for the estimates above. The basic idea is to reverse engineer expected return based on assumptions about risk. Rather than trying to predict return directly, this approach relies on the somewhat more reliable model of using risk metrics to estimate performance of asset classes. The process is relatively robust in the sense that forecasting risk is slightly easier than projecting return. With the necessary data in hand, we can estimate the implied risk premia using the following inputs:

◠an estimate of GMI’s expected market price of risk, defined as the Sharpe ratio, which is the ratio of risk premia to volatility (standard deviation).

â— the expected volatility (standard deviation) of each asset

â— the expected correlation for each asset with the overall portfolio (GMI)