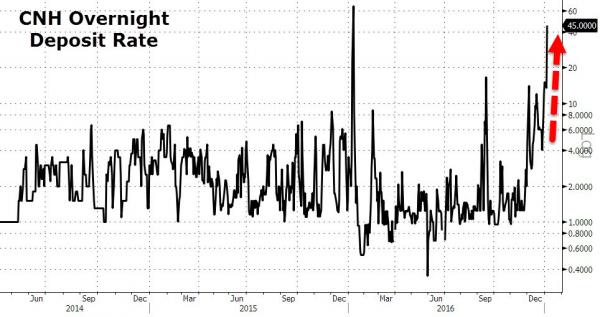

As one veteran trader noted “something is very broken.” After a massive short-squeeze sent the offshore yuan soaring during the US day session, overnight yuan deposit rates have exploded 31.5 percentage points higher to 45% – just shy of the record highs – as China’s interbank liquidity crisis is front-and-center. At the same time, coincidence or not, Bitcoin denominated in yuan has gone vertical, smashing through previous record highs.

Continuing the recent trend of demonstrably withdrawing liquidity, the People’s Bank of China injected a paltry CNY10 billion via seven-day reverse repos and skipped both 14-day and 28-day reverse repos at its open-market operations Thursday, according to traders. The moves resulted in a net drain of CNY140 billion for the day and a whopping CNY435 billion in liquidity at OMMOs so far this week. Yes, nearly half a trillion yuan in liquidity has been withdrawn in just the past week, a time when banks are already scrambling for every spare source of cheap funding.

As a result of this forced drain which was likely orchestrated by the central bank to crush any remaining shorts, and the utter desperation for liquidity, has prompted deposit rates to explode.

And perhaps whatever liquidity there is left is being placed elsewhere.

Smashing higher in the last few hours.

For now the short squeeze efforts of the PBOC are not extending the move in CNH.