**Important** Scores reflect first quarter seasonality.

The average score in small cap is 57.25. The average score over the past four weeks is 60.56. The average small cap stock in our universe is trading -21.98% below its 52 week high, 5.86% above its 200 dma, and has 6.83 days to cover short.

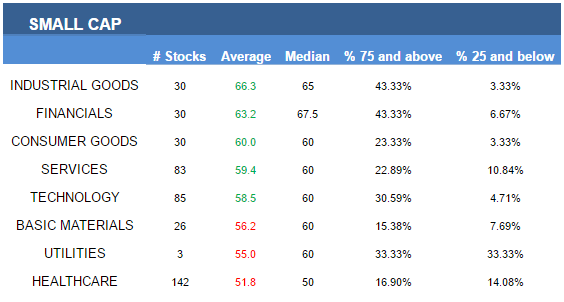

Industrials, financials, consumer, services, and technology score above average. Basics, utilities, and healthcare score below average.

The following small cap stocks offer the best first quarter seasonality:

Source.

Catalogs (FLWS, NSIT, GAIA), truckers (SAIA, MRTN), networking (SMCI, SILC), integrated semiconductor (DIOD), and P&C insurers (STFC, HMN, GLRE) are the best small cap industries.

Steel & iron (ROCK, HAYN), industrial metals, and oil & gas drillers (PKD) can be bought in basics. The best consumer group are auto parts (SMP) and processed & packaged goods. P&C insurers, regional banks (LTXB, MBWM, LKFN), and S&Ls (NWBI, OCFC, DCOM, BRKL) can be bought in financials. In healthcare, focus on medical instruments (UTMD, MMSI, LMAT, ATRS, ATRC), specialized health services (BEAT, USPH), and home health (CHE, AFAM). The strongest industrials groups are heavy construction (MTRX) and general building materials (HW). In services, concentrate on catalogs, truckers, and resorts/casinos (BYD). Networking, integrated semi, and internet information providers (BCOR) are best in technology.

Â