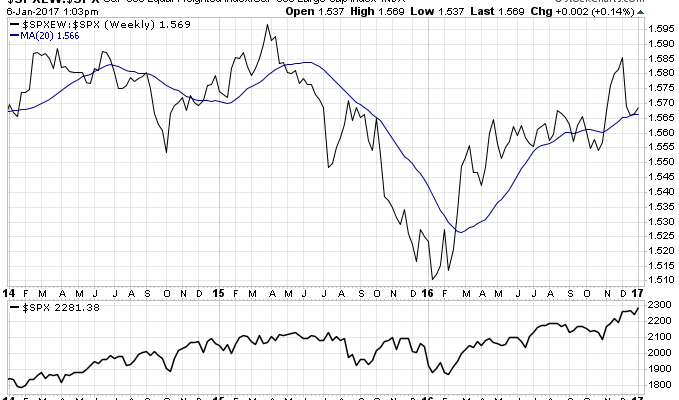

Since the US election in November, the market has had broad participation as evidenced by a strong relationship between the S&P 500 Equal Weight Index (SPXEW) and the S&P 500 Index (SPX). During the month of December, however, SPXEW didn’t keep up with SPX. The ratio between the two fell sharply as both small and large cap stocks stalled, while at the same time mega cap stocks gained support. Now, the ratio is turning back up in an apparent resumption of the widespread buying.

We can dig a little deeper into what stocks are getting the most attention by looking at the most bullish stocks on Twitter over the last two months, one month, and one week. Since the US election the most bullish stocks are across several industries.

During December, the list gravitated toward more technology and health care.

Over the past week, the list is once again widening in the number of industries listed. This is a condition we want to see going forward as evidence of widespread buying to support a rally.

Over the past week, my core market health indicators rose sharply. None of them moved enough to change any portfolio allocations, but nice to see them moving the right direction.

Conclusion

The widespread buying that we saw in November stalled during December, but is now attempting to resume. Bulls want to see breadth continue to rise as support for the current rally.