By ManiÂ

Amidst a low-rates environment and being a more stable part of global EM, one can expect Asian dollar bonds to still offer a decent return during the current year, according to UBS. Anna Ho and team said in their January 3 research note titled “The Asia Credit Analyzer†that they anticipate that the level of construction activities and infrastructure build uplift will sustain commodity demand in China into 2017.

Total return for Asian dollar bonds could touch 4.67%

Ho and colleagues point out that last year, the yield and credit curves for Asian dollar bond prices steepened along with rising UST yields, with the market adjusting to the developments on a new U.S. administration front. The analysts note that Asian dollar bonds gave back about 2 percentage points of their 2016 gains since the U.S. election results were announced, returning 7.7% YTD.

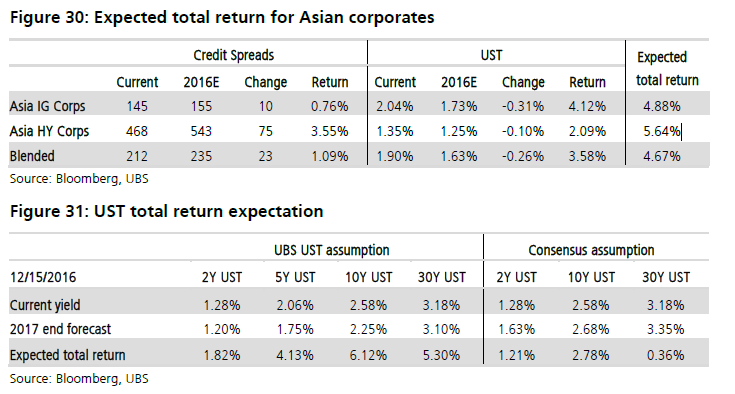

Factoring in GDP growth and inflation forecasts of 2.4% and 2.6%, respectively, the UBS analysts anticipate that 10Y UST will end 2017 at 2.25%. The analysts believe the total return for Asian dollar corporate bonds will touch 4.67% this year, and they expect the volatile movement in rates to offer better trading opportunities in Asian dollar bonds. They anticipate that IG and HY corporate returns will reach 4.88% and 5.64%, respectively. They also believe IG returns will be sensitive to UST moves, considering the lower credit spreads in the cycle:

The following matrix provides a two-dimensional view of the UBS analysts’ total return projections by capturing tenor and rating:

The following table sets forth the analysts’ segment recommendations for 2017. They have upgraded corporate perps to Overweight, while staying Neutral on Chinese AMCs, Indian bank senior and corporates.

UBS analysts predict opportunities in corporate perpetual bonds

Taking a closer look at the bond pipeline, Ho and colleagues point out that for 2017, there are $3.6 billion and $11 billion of maturing and callable USD bonds, respectively. After factoring in gross redemptions, the analysts anticipate that net issuance will actually turn out to be in the negative territory of $8.3 to 10.5 billion.