Along with most of his Wall Street peers, BofA’s Chief Investment Strategist Michael Hartnett flipped his outlook on risk assets shortly after the election, turning from quietly bearish to vocally bullish and forecasting a substantial rise in US equities, and even more substantial bounce for Japanese, European and UK stocks as well as oil.

So far, Hartnett has been correct, and according to recent fund flows, much of the investing community agrees.

Some specifics: in the last week, according to EPFR, there were both strong bond inflows ($6.3bn) as well as equity inflows ($5.5bn) offset by modest commodity outflows ($0.2bn). Curiously, unlike in the earlier part of the reflation trade when buying of equities was funding from bond liquidations, last week we saw the strongest week of bond inflows in 3 months, which followed $41.5bn of redemptions in past 8-weeks – the largest redemptions since taper tantrum.

A more nuanced look into bond flows shows that investors added risk, with another week of redemptions from Treasuries but 1st inflows to EM debt funds in 9 weeks, 2nd week of renewed inflows to IG bond funds, and 6th consecutive week of inflows to HY bond funds. In other words, “risk proxies” in the bond world are getting hot again.

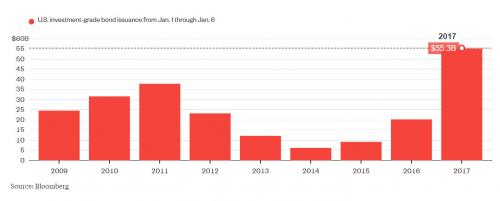

Perhaps nowhere is this more obvious than what is going on in the primary issuance market. Here, as Bloomberg notes, debt sales are blowing through all records, with the biggest volumes of issuance ever for the first week of January, as top-rated U.S. companies are selling bonds at the fastest pace ever to start a year.

And while gold & EM equities remained shunned, which gold posting an 8th consecutive week of outflows, the longest outflow streak in 3 years, as well as European & EM equities, which are largely ignored by investors, US equities remain quite hospitable, attracting $5.5 billion in new funds in the past week. By sector, EPFr notes that there were 15 straight weeks of financials inflows ($0.8bn); first inflows to REITs in 9 weeks ($0.7bn); 6 straight weeks of healthcare outflows ($0.2bn). Sadly for the active management community, there was more bad news as ETFs attracted $9.2 billion in the first week of the year, offset by $3.7 billion in long-only fund outflows.