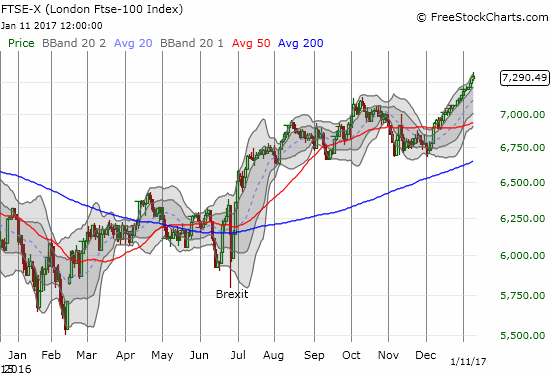

The UK’s FTSE 100 remains a big post-Brexit winner. This headline from the Telegraph for January 10, 2017 says it all: “FTSE 100 records longest run of closing highs since 1984 as Brexit fears hurt pound.â€

Straight up for the FTSE 100 for over a month…

The FTSE 100 was created in 1984. Never since that time has the index notched nine straight all-time highs as it has done now. The eleven straight days of gains is also an all-time record for the index. This run matches similar runs in 1997, 2004 and 2009.

These gains are coming partially at the expense of the British pound (FXB). The pound last peaked in early December against the U.S. dollar and the euro. Against the yen, the pound last peaked in mid-December. For each currency pair, important technical milestones have occurred.

GBP/USD is challenging multi-decade lows again. A 50DMA breakdown on December 15th was confirmed by failure at resistance last week.

EUR/GBP gave its 200DMA a serious and successful test in December. The month ended with a major 50DMA breakout that was confirmed last week with a renewed surge off its 50DMA as support.

This week started with a major 50DMA breakdown for GBP/JPY. The move was just as dramatic as the parallel 200DMA major breakout at the end of November.

GBP/AUD never broke through its 200DMA downtrend which was confirmed as resistance after Brexit. If history is any guide, the major 50DMA breakdown from last week is just the beginning of a new, long slide.

Source for charts:Â FreeStockCharts.com

Taken together, these technical developments have confirmed my nascent fear from early December that buying interest in the British pound was starting to dry up. The reversal in outlook forced me to switch the bias of my trading on the British pound from hedged bullish to mainly bearish. I am particularly interested in fading a (relief) rally on GBP/AUD despite my growing bearishness on the Australian dollar.