Prospect Capital (PSEC) is an income-investor favorite because it offers an outsized 11.6% dividend yield, paid monthly. However, we believe Prospect is considerably less attractive than it was at this time last year. In fact, we sold our shares of Prospect last week because we believe the market cycle and unintended regulatory consequences may be turning against the company, and its valuation and dividend coverage ratio are becoming decidedly less attractive. In addition to reviewing these big risks facing Prospect, this article also highlights three big dividend investments that we believe are healthier and more attractive than Prospect Capital.

Market Cycle Risk:

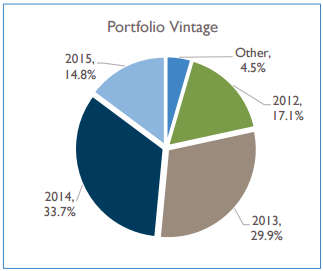

In recent years, Prospect Capital has enjoyed high yields on its debt investments and high returns on its equity investments because that’s what the market cycle gave to Prospect. Specifically, as the economy continued to recover from the financial crisis, Prospect continued to benefit from investments that appeared to be “high-risk†at the time they were made, but turned out to be largely “high-reward†because the market has risen from distress to stability. For perspective, the following chart shows the “vintage years†of Prospect’s investment portfolio which constantly moves further into the future as juicy distress-year investments roll off the books and less-juicy normalized investments roll on.

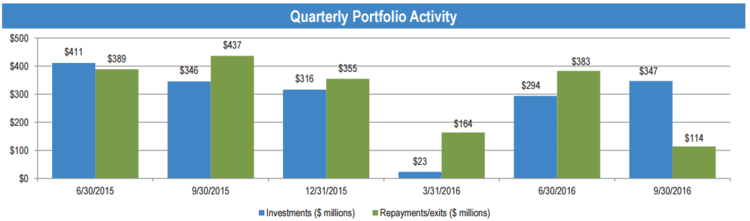

For added perspective, this next chart shows Prospect’s recent quarterly investment activity in terms of what is rolling off each quarter (“Repayments/exitsâ€) and what is rolling on (“Investmentsâ€).

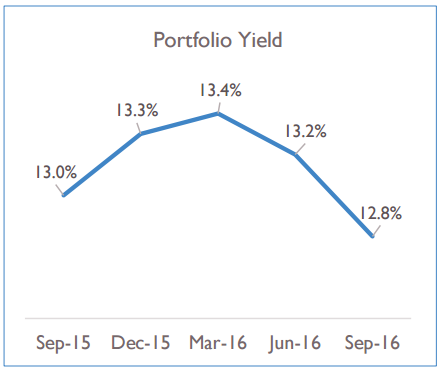

And for more color, this next graphic shows Prospect’s portfolio yield, which has been declining recently, and may continue to decline in the future based on market conditions.

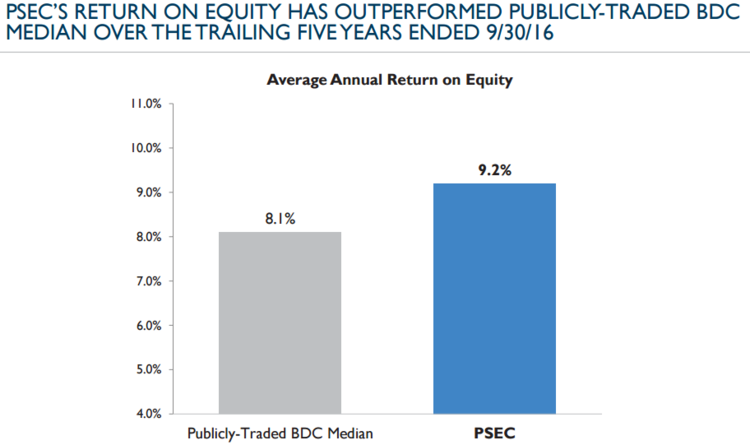

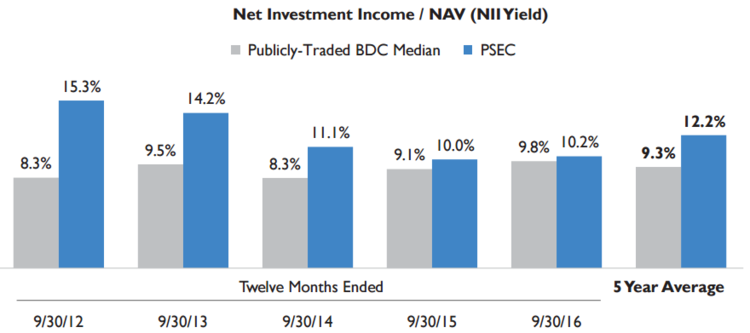

Worth considering, one thing Prospect likes to tout in its quarterly investment presentations is how it has delivered a higher return on equity (ROE) than its peers, as shown in the following chart.

And while ROE is perhaps a more comprehensive performance measurement than the popular net investment income (NII) because, unlike NII, ROE also captures net realized gains and losses, ROE can be misleading. Specifically, as this next chart alludes to, NII/NAV is declining, not necessarily because NII is declining (although it has in the last three quarters, more on this later) but because NAV has been increasing (relative to NII) as distressed assets purchased at distressed prices recover (and as management is perversely incentivized to grow AUM, more on this later).Â

And the distressed assets have recovered not just because of PSEC’s great underwriting standards, but also because of where we are in the market cycle (i.e. the market/economy has recovered, and while this is out of PSEC’s control, PSEC has certainly benefitted).

For added perspective, this next chart shows Prospect’s declining ROE in recent years as we move further away from the financial crisis vintage year originations/investments.

Worth considering, PSEC trades somewhat similarly to publicly-traded high-yield debt as represented by ticker JNK and shown in the following correlation table.

Specifically, PSEC has a higher correlation to high yield debt over the last five years than it has to the S&P 500 (SPY) or to small cap stocks (IWM), which makes sense considering the types of loans PSEC is actually making (i.e. the loans, and equity investments, are being made to relatively higher-risk middle market companies). And for further perspective, high-yield bonds just had a great 2016 (and a great 8-year run, following the financial crisis) which suggest, from a contrarian standpoint, high-yield may not perform as well going forward and neither will Prospect.