While US stocks closed near session, and all time highs on Friday, the first green close on inauguration day in over 50 years, Monday has seen a modest case of buyer’s remorse, with European stocks sliding, Asian shares mixed and U.S. futures lower as the dollar weakened for the 3rd consecutive day to a six-week low, dropping as much as 1% against the Yen, as anxious investors awaited more details of Donald Trump’s policies, or – as Reuters put it – the “Trump reality set in.” While European shares and US equity futures sold off in early trading, tracking the USDJPY, the now traditional buying levitation wave has emerged, pushing US futures close to unchanged on the session.

The modest risk off session,which comes after world stocks hit multi-year highs earlier this month on expectations Trump would boost growth and inflation with extraordinary fiscal spending measures, has seen shares in developed markets fall with the dollar, while lifting metals and Treasuries after Donald Trump offered little more on plans to boost growth while stirring concerns over protectionism in his first days in office. Europe’s Stoxx 600 Index dropped to its lowest level this year, while U.S. futures slid and the dollar fell against all major peers. The weaker currency pushed aluminum to the highest in more than a year, while ten-year Treasury yields fell a second day.

“The focus this morning is on the protectionist rhetoric and the lack of detail on economic stimulus, so it’s a nervous start (to the presidency),” said Investec economist Victoria Clarke. “The other concern is how the Fed interprets Trump’s stance, the worry being the less he does on fiscal stimulus the more nervous they may get on pushing the rate hikes through.”

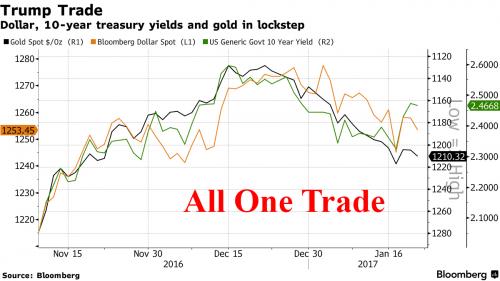

While the U.S. President’s campaign-trail promises to boost growth and spending helped drive a post-election rally in equities and the dollar, by Monday, investors were calling into question how words would be translated into actions. So far, Trump has focused on a feud with the press over attendance at his inauguration rather than offer concrete plans, leaving investors in limbo. As the chart below shows, while stock dispersion may have risen in recent weeks, cross-asset correlation remains as high as ever, with most asset classes trading largely as a continuation of the Trump trade.

“The markets and a lot of international investors, whilst they’re nervous about Trump’s geopolitical and trade aspirations, have wanted to believe the reflation trade,†Neil Dwane, a chief investment officer at Allianz Global Investors Capital LLC told Bloomberg Television. “We’re seeing now is that it is going to be hard. The optimism was always way ahead of what Trump would be able to deliver and now you’re seeing some profit-taking.”

Rabobank analyst Michael Avery said a more protectionist United States could lead to a U.S. dollar liquidity squeeze, with Mexico and Asia likely the most badly hit. “We would see outright confusion over what currency to invoice, trade, and borrow in: a 19th century world of competing reserve currencies in different geographic zones, but without the underpinning of gold,” Avery said in a note. The problem would be exacerbated if China tightens capital controls further, he said.

Across global equities, the Stoxx 600 benchmark index fell to its lowest level since December. Generali jumped as much as 7.1 percent on speculation of a takeover bid for the Italian insurer. Spanish lender Banco de Sabadell dropped after disclosing that the maximum amount it might have to repay to clients in the mortgage-floors ruling exceeds the last two quarters of profit. Other Spanish banks also dropped as clients prepare to claim back interest payments. European stocks fell 0.7 percent and the broader Euro STOXX 600 fell 0.6 percent in early trades on Monday, both hitting their lowest level this year so far.

Japan’s Nikkei dropped 1.1% while shares in Australia dropped 0.8 percent after Trump’s administration also declared its intention to withdraw from the Trans-Pacific Partnership (TPP), a 12-nation trade pact that Japan and Australia have both signed. Other Asian shares were more resilient, however, in part due to the dollar’s weakness, and MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.3 percent.

The U.S. Federal Reserve, which has indicated that it expects to raise its benchmark interest rate three times this year, is due to hold its next meeting on Jan. 31 and Feb. 1.

S&P 500 futures dropped 0.2 percent, while the main gauge closed 0.3 percent higher Friday.

The nervous start on Monday saw safe haven assets in demand. The yield on Germany’s 10-year government bond, the benchmark for the region, led most euro zone bonds lower, dropping 4 basis points to 0.32 percent in early trade. This followed 10-year U.S. Treasuries yields, which fell to 2.43 percent, after having risen briefly on Friday to 2.513 percent, its highest since Jan. 3. Spot gold prices, meanwhile, rose on Monday to their highest in two months.

Money managers will be dissecting earnings from some of the world’s largest companies this week with Alphabet Inc., Samsung Electronics Co. and Alibaba Group Holding Ltd. all reporting results.

* * *

Bulletin Headline Summary From RanSquawk

- European equities have kicked the week off on the backfoot with underperformance in financials and macro newsflow relatively light

- FX markets have seen cautious trade in the lead USD pairings, led by the USD/JPY pullback below 114.00

- Looking ahead, highlights include potential comments from ECB’s Draghi and Praet

Market Snapshot

- S&P 500 futures down 0.2% to 2262

- Stoxx 600 down 0.3% to 362

- FTSE 100 down 0.6% to 7152

- DAX down 0.4% to 11581

- German 10Yr yield down 2bps to 0.4%

- Italian 10Yr yield up less than 1bp to 2.03%

- Spanish 10Yr yield down less than 1bp to 1.5%

- S&P GSCI Index down 0.2% to 398.8

- MSCI Asia Pacific up 0.2% to 140

- U.S. 10-yr yield down less than 1bp to 2.46%

- Dollar Index down 0.35% to 100.39

- WTI Crude futures down 0.8% to $52.81

- Brent Futures down 0.5% to $55.24

- Gold spot up 0.2% to $1,213

- Silver spot up 0.2% to $17.13