US equity futures were flat, European stocks rose and Asia was mixed after the dollar posted a modest rebound overnight despite Mnuchin’s “strong dollar” comments, while oil was flat and gold fell, as investors focused on President Donald Trump’s plans to boost growth. The pound fell after a U.K. court ruled that Parliament must vote on triggering Brexit.

The dollar struggled in Asia on Tuesday as U.S. President Donald Trump’s focus on protectionism ahead of fiscal stimulus fueled suspicions his administration might be content to gain a competitive advantage through a weaker currency. However, early European trading saw modest gains in the USD, which rose to 113.4 in the USDJPY after dropping as low as 112.52, while the EURUSD declined to 1.73 after rising as high as 1.77 in Asian trading.The talk of trade wars came even as more data pointed to a welcome revival in activity worldwide. A survey of Japanese manufacturing out Tuesday showed the fastest expansion in almost three years as export orders surged. Indeed, sentiment took an early knock when Mnuchin told senators that he would work to combat currency manipulation but would not give a clear answer on whether he views China as manipulating its yuan.

Still, the recent euphoria surrounding the Trumpflation trade now appears largely gone: “It’s interesting that markets did not respond positively to a reaffirmation of lower taxes and looser regulation, reinforcing the impression that all the good news is discounted for now,” wrote analysts at ANZ in a note. “As week one in office gets underway, there is a growing sense of scepticism, not helped by the tone of Friday’s inaugural address and subsequent spat with the media.”

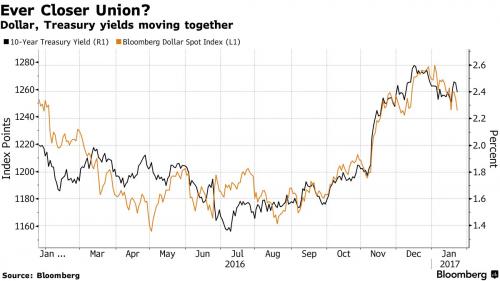

Doubts about exactly how much fiscal stimulus might be forthcoming helped Treasuries rally. Yields on 10-year notes eased to 2.39 percent, having enjoyed the steepest single-day drop since Jan. 5 on Monday.“The driver of a shift higher will be optimism that President Trump’s policies deliver more growth,†Juckes said. “If he starts tweeting about fiscal policy instead of trade policy maybe the bond bears can come out of hibernation again.†As the chart below shows, the dollar continues to trade in lockstep with 10Y TSY yields.

As traders arrive at their desks in the US, the greenback has managed to advance against most major currencies, reversing declines sparked after Treasury Secretary nominee Steven Mnuchin said on Monday afternoon that a strong U.S. currency could have a negative short-term effect on the economy.  In written answers to a Senate Finance Committee, Mnuchin also reportedly said an excessively strong dollar could be negative in the short term.

The pound extended losses after judges ruled Prime Minister Theresa May must ask Parliament to trigger the two-year countdown to the U.K.’s departure from the European Union, handing lawmakers a chance to soften the plan. Gold fell after touching the highest since November while oil climbed above $53 a barrel.

MSCI’s broadest index of Asia-Pacific shares outside Japan edged up 0.4 percent, while Shangahi was flat and the Nikkei slipped 0.4 percent.European stocks halted a three-day decline, led by Italian shares amid reports that Assicurazioni Generali SpA may get investment from Intesa Sanpaolo SpA and Allianz SE.

S&P 500 futures were lower by 1 point at publication.

The yield on the 10-year Treasury rose three basis points to 2.42 percent.

Market Snapshot

- S&P 500 futures down less than 0.1% to 2261

- Stoxx 600 up 0.2% to 362

- FTSE 100 up 0.2% to 7167

- DAX up 0.2% to 11567

- German 10Yr yield up 2bps to 0.38%

- Italian 10Yr yield up 1bp to 2%

- Spanish 10Yr yield up 3bps to 1.46%

- S&P GSCI Index up 0.7% to 401.5

- MSCI Asia Pacific down less than 0.1% to 140

- Nikkei 225 down 0.5% to 18788

- Hang Seng up 0.2% to 22950

- Shanghai Composite up 0.2% to 3143

- S&P/ASX 200 up 0.7% to 5650

- US 10-yr yield up 2bps to 2.42%

- Dollar Index up 0.12% to 100.28

- WTI Crude futures up 0.9% to $53.22

- Brent Futures up 0.9% to $55.75

- Gold spot down 0.4% to $1,213

- Silver spot down 0.6% to $17.13

Top News

- Mnuchin Says Excessively Strong Dollar May Hurt U.S. Economy

- Australia Pushes for TPP Without U.S. After Trump Exits Deal

- Trump Said to Tell Lawmakers ‘Illegals’ Cost Him Popular Vote

- Brexit vote

- Goldman Hails Global Rebound as Currie Sees Commodity Demand

- Emirates Stokes Ire of U.S. Airlines With Flights Through Greece

- OPEC Helps Cheap U.S. Oil Find Its Way to Group’s Top Buyers

- Nike (NKE) and Ford (F) Caught in Crossfire of Trump’s Trade Overhaul

Asia stocks traded mixed following a subdued lead from Wall St. where US indices finished mostly lower amid investor uncertainty during Trump’s first day in office. ASX 200 (+0.7%) outperformed led by mining names following gains across the metals complex on the back of a weaker USD, while Nikkei 225 (-0.6%) was pressured by recent JPY strength in which USD/JPY declined below 113.00. Shanghai Comp. (+0.2%) and Hang Seng (+0.2%) traded with an indecisive tone following a weaker liquidity operation by the PBoC and as participants look ahead to Lunar New Year. 10yr JGBs were higher and tracked the gains seen in T-notes amid outperformance in the long-end, while participants also digested the latest results of the 40yr auction which resulted in a slightly higher b/c