The Risks and Rewards of Asian Real Estate

- Shanghai house prices increased 26.5% in 2016

- International investment in Asian Real Estate is forecast to grow 64% by 2020

- Chinese and Indian Real Estate has underperformed US stocks since 2009

- Economic and demographic growth is supportive Real Estate in several Asian countries

Donald Trump may have torn up the Trans-Pacific Partnership trade agreement, but the economic fortunes of Asia are unlikely to be severely dented. This week Blackstone Group – which at $102bln AUM is one of the largest Real Estate investors in the world – announced that they intend to raise $5bln for a second Asian Real Estate fund. Their first $5bln fund – Blackstone Real Estate Partners (BREP) Asia – which launched in 2014, is now 70% invested and generated a 17% return through September 2016. Blackstone’s new vehicle is expected to invest over the next 12 to 18 months across assets such as warehouses and shopping malls in China, India, South-East Asia and Australia.

Last year 22 Asia-focused property funds raised a total of $10.6bln. Recent research by Preqin estimates that $33bln of cash is currently waiting to be allocated by existing Real Estate managers.

Blackrock, which has $21bln in Real Estate assets, predicts the amount invested in Real Estate assets will grow by 75% in the five years to 2020. In their March 2016 Global Real Estate Review they estimated that Global REITs returned 10% over five years, 6% over 10 years and 11% over 15 years.

This year – following the lead of countries such as Australia, Japan and Singapore – India is due to introduce Real Estate Investment Trusts (REITs) they also plan to permit infrastructure investment trusts (InvITs). Other Asian markets have introduced REITs but not many have been successful in achieving adequate liquidity. India, however, has the seventh highest home ownership rate in the world (86.6%) which bodes well for potential REIT investment demand.

UK asset manager M&G, make an excellent case for Asian Real Estate, emphasis mine:-

Exposure to a diversified and maturing region which accounts for a third of the world’s economic output and offers a sustainable growth premium over the US and Europe.

Diversification benefits. An allocation to Asian real estate boosts risk-adjusted returns as part of a global property portfolio; plus there are diverse opportunities within Asia itself.

Defensive characteristics, with underlying occupier demand supported by robust economic fundamentals, as showcased by Asia’s resilience during the European and US downturns of the recent financial crisis.

What M&G omit to mention is that investing in Real Estate is unlike investing in stocks (Companies can change and evolve) or Bonds which exhibit significant homogeneity – Real Estate might be termed the ultimate Fixed Asset – Location is a critical part of any investment decision. Mark Twain may have said, “Buy land. They’re not making it anymore.†but unless the land has commercial utility it is technically worthless.

The most developed regions of Asia, such as Singapore, Hong Kong, Japan and Australia, offer similar transparency to North America and Europe. They will also benefit from the growth of emerging Asian economies together with the expansion of their own domestic middle-income population. However, some of these markets, such as China, have witnessed multi-year price increases. Where is the long-term value and how great is the risk of contagion, should the US and Europe suffer another economic crisis?

In 2013 the IMF estimated that the Asia-Pacific Region accounted for approximately 30% of global GDP, by this juncture the region’s Real Estate assets had reached $4.2trln, nearly one third of the global total. During the past decade the average GDP growth of the region has been 7.4% – more than twice the rate of the US or Europe.

The problem for investors in Asia-Pacific Real Estate is the heavy weighting, especially for REIT investors, to markets which are more highly correlated to global equity markets. The MSCI AC Asia Pacific Real Estate Index, for example, is a free float-adjusted market capitalization index that consists of large and mid-cap equity across five Developed Markets (Australia, Hong Kong, Japan, New Zealand and Singapore) and eight Emerging Markets (China, India, Indonesia, Korea, Malaysia, the Philippines, Taiwan and Thailand) however, the percentage weighting is heavily skewed to developed markets:-

| Country | Weight |

| Japan | 32.94% |

| Hong Kong | 26.40% |

| Australia | 19.81% |

| China | 9.62% |

| Singapore | 6.30% |

| Other | 4.93% |

Source: MSCI

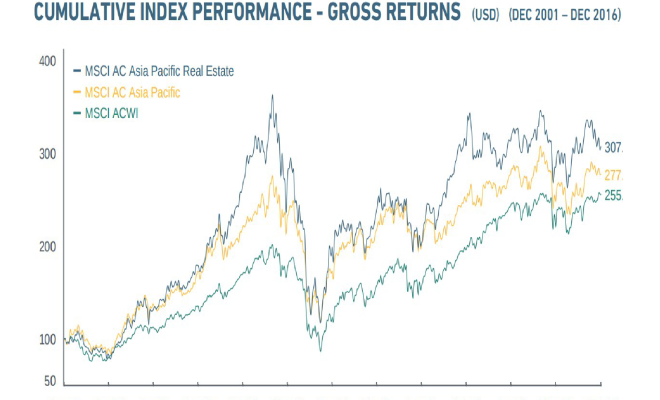

Here is how the Index performed relative to the boarder Asia-Pacific Equity Index and ACWI, which is a close proxy for the MSCI World Index:-

Source: MSCI

The MSCI Real-Estate Index has outperformed since 2002 but it is more volatile and yet closely correlated to the Asia-Pacific Equity or the ACWI. The 2008-2009 decline was particularly brutal.